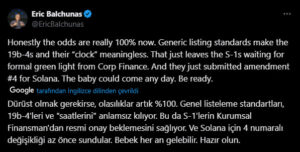

Bloomberg ETF analyst Eric Balchunas predicts that the approval of a Solana ETF will happen with a 100% probability. The analyst’s assessment is supported by changes in the SEC’s regulatory stance and the streamlined S-1 approval processes.

Recently, the SEC has adopted a more flexible and standardized approach for crypto ETFs, significantly reducing uncertainty around altcoin-based ETF products. This has increased confidence in a Solana ETF among both institutional and retail investors.

Regulatory Hurdles Are Easing

According to Eric Balchunas, the SEC’s adoption of general listing standards and the simplifications in S-1 registration processes remove the biggest obstacles to Solana ETF approval. Previously critical, the 19b-4 exchange rule change applications have now become less decisive.

The analyst notes that these changes accelerate the approval process and reduce uncertainty for investors. Balchunas says:

“The SEC’s approach is now more transparent and predictable. For a strong altcoin like Solana, ETF approval seems inevitable for investors.”

A New Regulatory Environment for Spot Crypto ETFs

Deadlines for a spot crypto ETF for Solana are approaching in a more favorable regulatory environment following SEC-led changes. Under the current administration, this shift toward supporting altcoin products has created growing optimism regarding Solana ETF approval.

Traditional financial firms like Vanguard are closely monitoring these developments and are taking the opportunity to achieve broader industry alignment with digital asset products. As regulatory hurdles ease, both industry players and institutional investors are gaining confidence that Solana ETFs will be approved.

Analyst Commentary and Market Expectations

According to Balchunas, approval of a Solana ETF will boost both investor confidence and institutional interest in the crypto market. The launch of spot and futures ETF products will increase Solana’s liquidity and contribute to price stability.

The analyst also emphasizes that investors should closely follow the S-1 process and regulatory developments:

“ETF approval is just the beginning. This process will bring greater market transparency and increase institutional investor interest.”

In the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube, and Twitter for the latest news and updates.