Bloomberg analyst Mike McGlone stated in his 2026 market outlook that both silver and Bitcoin could be at risk of potential losses. McGlone emphasized that while both assets face downside risk, the underlying reasons differ significantly. He noted that the risk in silver largely stems from prices trading well above historical averages, whereas in Bitcoin’s case, current levels being below the 50-week moving average suggest a search for a market bottom. According to McGlone, these differing dynamics present separate risks that investors must evaluate individually, underscoring the importance of a strategic approach in both markets.

Risk of Overvaluation in Silver

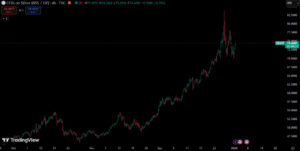

According to McGlone’s analysis, silver is trading at around $74 per ounce. This level is approximately 73% above its 50-week moving average. The analyst pointed out that such a high premium has been seen only once in history—back in 1979.

At that time, silver peaked at around $50 in 1980 and then experienced a sharp decline of 52%, falling to roughly $15.5. McGlone noted that silver closed above its 1979 year-end level of $32.2 at the end of 2025, which increases the risk of overvaluation. This situation is considered a significant warning signal for investors.

Signs of a Search for a Bottom in Bitcoin

The picture is different on the Bitcoin side. According to McGlone, Bitcoin is trading at around $88,000, which is approximately 13% below its 50-week moving average. Historical data suggest that such discounted levels often indicate that the market may be entering a bottom-finding phase. McGlone cautioned that, based on past cycles, the possibility of a 50% to 55% decline in Bitcoin should not be ruled out. This warning highlights the need for investors to prioritize risk management.

Assessment

According to McGlone’s analysis, investors in both silver and Bitcoin should act cautiously in 2026. The risk in silver stems from prices trading well above historical averages, while Bitcoin’s current levels below the 50-week moving average suggest the market may still be searching for a bottom. In this context, it becomes increasingly important for investors to closely monitor market dynamics, technical indicators, and historical cycles for both assets.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.