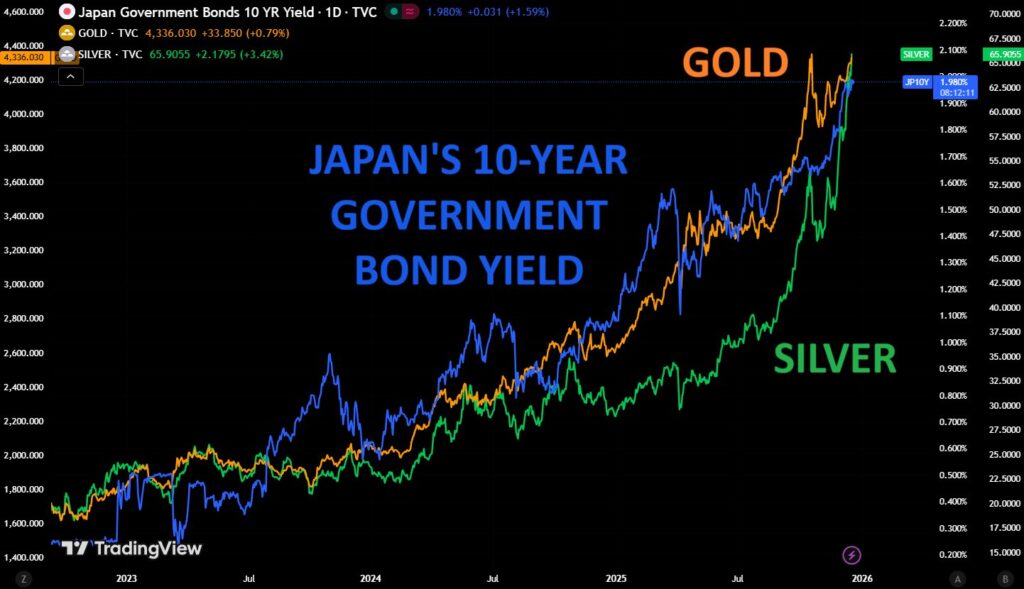

Japan’s 10-year bond yield surged to 1.98% in December 2025 as the Bank of Japan (BOJ) exits decades-long ultra-loose monetary policy, triggering shifts in global liquidity. Gold and silver have gained value as safe-haven assets amid rising sovereign risk and tighter global financial conditions, while Bitcoin faces selling pressure. Investors are closing yen carry trade positions, causing forced deleveraging across Asian markets.

Why It Matters?

Japan’s yields have reached the highest levels since the 1990s, impacting not only local markets but also global capital flows directly.

BOJ Bond Yield Hits 1.98%

For decades, Japan maintained near-zero interest rates, supporting global liquidity through yen carry trades. Investors borrowed low-yield yen to invest in higher-return assets abroad.

The expected 25-basis-point increase in December 2025, raising rates to 0.75%, may seem modest, but the speed of the change is critical for markets. Analysts emphasize that the BOJ move has far-reaching implications beyond Japan.

Gold and Silver Prices Surge Amid Rising Risk

Global data shows gold and silver move almost in line with Japanese bond yields. This indicates that investors are seeking protection against rising sovereign debt costs. Meanwhile, gold trades at around 4,324 USD per ounce and silver at approximately 66 USD per ounce in global markets. Since early 2023, gold and silver have gained 135% and 175%, respectively.

The silver market shows speculative behavior. The China Silver Futures Fund traded 12% above the physical metal it tracks, suggesting leveraged demand exceeds the underlying asset. Investors now treat gold and silver as hedges against broader macro risks, not just inflation.

Bitcoin Faces Pressure

Bitcoin is under strain from tightening yen liquidity. According to XWIN Research Japan, “Persistent spot selling occurs across Asian exchanges. Miner reserves are dropping — forced sales, not voluntary…Long-term Asian holders are distributing…Price remains pressured until forced supply clears.”

While US institutions continue buying, forced liquidations in Asia and an 8% drop in Bitcoin hashrate add downward pressure. Previous BOJ rate shifts coincided with major BTC declines, and traders are closely watching for potential downside toward $70,000.

The contrasting reactions of gold, silver, and Bitcoin highlight differences in risk positioning. Gold and silver attract safe-haven flows, while Bitcoin faces liquidation-driven price pressure. Future Fed rate cuts may offset the BOJ’s impact, but the speed of the policy change remains critical.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.