Tensions between the Bitcoin community and traditional financial institutions have escalated after reports surfaced that MSCI may remove crypto-treasury-heavy companies from its indexes beginning in 2026. The news, shared in a research note by JP Morgan, triggered widespread backlash on social media, where both JP Morgan and MSCI quickly became focal points of criticism.

MSCI’s Potential Policy Shift Sparks Outrage

MSCI, formerly known as Morgan Stanley Capital International, plays a central role in shaping global investment flows by determining the criteria for major market indexes. According to early indications, the firm is preparing to exclude companies that hold 50% or more of their balance sheets in crypto assets.

Such a move could significantly impact affected companies. Index funds are required to invest only in firms that meet specific inclusion criteria, meaning exclusion could trigger forced selling by passive investment vehicles. This could also weaken the capital inflows that many publicly listed crypto-treasury companies currently rely on.

Bitcoin Advocates Target JP Morgan: “Start the Boycott”

After JP Morgan relayed MSCI’s stance in its research report, anger surged across the Bitcoin community. Real estate investor and prominent Bitcoin supporter Grant Cardone said he withdrew $20 million from Chase and is pursuing legal action over alleged credit card misconduct—publicly backing calls for a boycott against JP Morgan.

Another well-known Bitcoin advocate, Max Keiser, urged investors to “crash JP Morgan and buy Strategy and BTC,” amplifying the boycott narrative. The rapid spread of these reactions highlights the growing divide between conventional financial institutions and cryptocurrency proponents.

Strategy Founder Michael Saylor Responds to the Proposed Change

Strategy, one of the companies potentially affected, entered the Nasdaq 100 index in December 2024, gaining substantial benefits from passive capital flowing into the benchmark. With MSCI’s proposed criteria change, attention shifted toward Strategy’s founder, Michael Saylor.

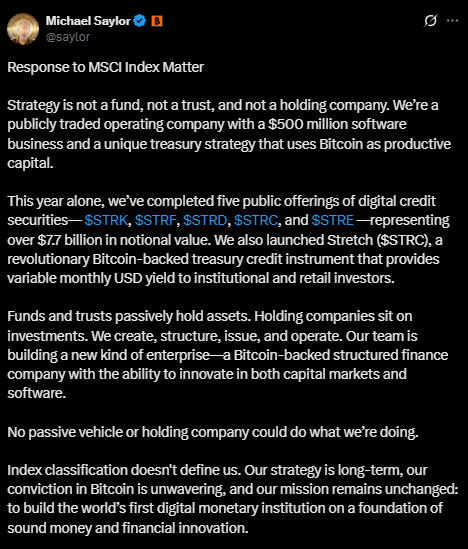

In a public statement, Saylor emphasized that Strategy is being misclassified:

“Strategy is not a fund, not a trust, and not a holding company. We create, structure, issue, and operate. Strategy is a Bitcoin-backed structured finance company.”

Saylor’s comments reflect the company’s stance that the updated criteria should not apply to its business model.

How the New Criteria Could Impact the Bitcoin and Crypto Market

If MSCI enforces the new rules, companies with balance sheets heavily weighted in crypto assets will face two options:

-

Reduce their crypto exposure to meet the threshold for index inclusion

-

Or remain outside major indexes and lose access to passive capital flows

Analysts warn that forced adjustments by these firms could trigger rapid sell-offs, potentially putting downward pressure on digital asset prices.

You can freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.