The American Central Bank (FED) made its interest rate decision.

The interest rate was kept constant at 4.50%.

Futures show that investors predict that there is a 68% probability that the Fed will cut interest rates by at least 25 basis points at the September meeting.

Statements Made After the Fed Rate Decision;

Fed Members Waller and Bowman dissented, preferring to cut the interest rate by a quarter point.

(JPMorgan’s Michele: We should pay attention to the two dissenting views.)

Fed: The unemployment rate remains low and labour market conditions remain solid.

Fed: Recent indicators suggest that the growth of economic activity is slowing in the first half of 2025.

White House: Trump’s proclamation imposes a universal 50% tariff on imports of semi-finished copper products and copper-intensive derivatives from 1 August.

White House: Trump signed a decree imposing an additional 40% tariff on Brazil, bringing the total amount of tariffs to 50%.

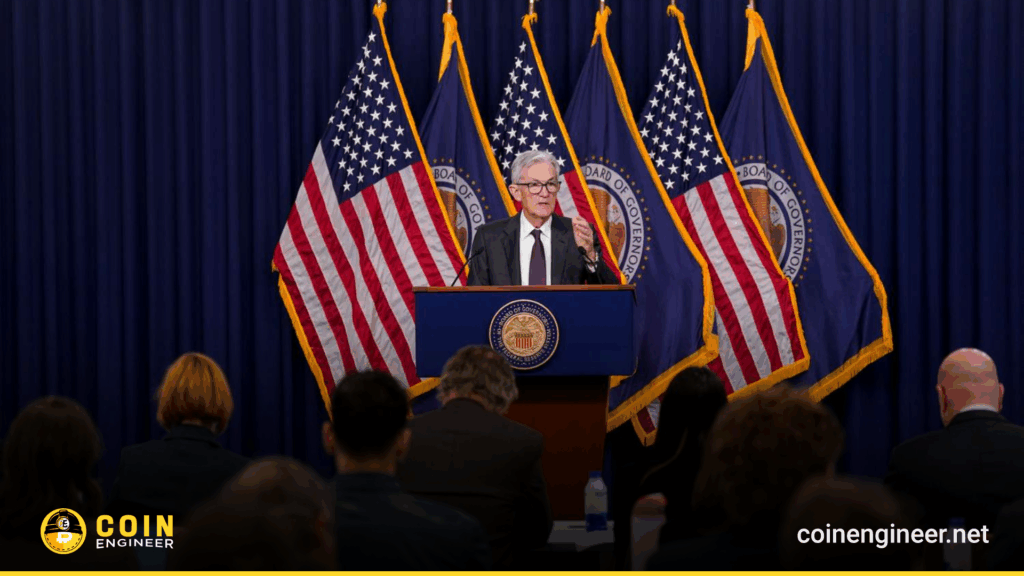

FED Chairman Powell’s statements after the FED interest rate decision;

Fed Chairman Powell: Indicators show that economic growth is slowing.

Fed Chairman Powell: Inflation is slightly above the 2% target.

Powell: Labour market conditions are broadly balanced and unemployment remains low.

Powell: A broad range of indicators suggest that the labour market is close to maximum employment.

Powell: I expect PCE to rise by 2.5% and core spending by 2.7% in the 12 months to June.

Powell: Tariffs increase the prices of some goods.

Powell: Most measures of long-term inflation expectations are consistent with the Fed’s target.

Powell: The slowdown in growth reflects a slowdown in consumer spending.

Powell: Tariffs have put pressure on some goods, but the broader impact is uncertain.

Powell: A plausible baseline scenario is a short-lived tariff inflation effect.

Powell: Possible inflationary effects could be more persistent.

Powell: The policy review is expected to be completed by the end of summer.

Powell: There is downside risk in the labour market.

Powell: We have not taken a decision on the interest rate in September, we expect to have more information in the coming months.

Powell: There is a lot of uncertainty since the last meeting.

Powell: GDP and PDFP figures came in exactly at the level we expected.