After the sharp liquidation wave in October, the persistent tension that has weighed on crypto markets for months is beginning to ease. Defensive positioning, which dominated investor behavior through late 2025, has started to soften, replaced by a more balanced — though still cautious — tone.

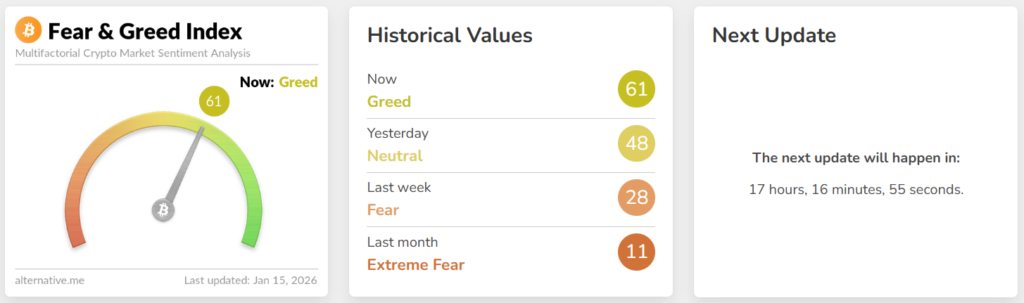

This shift is now visible in sentiment indicators. The Crypto Fear & Greed Index has moved back into positive territory for the first time since October, signaling a notable change in investor psychology.

October’s Liquidity Shock Left a Lasting Mark

The October liquidation event, which saw roughly $19 billion exit crypto markets, triggered a sharp break in confidence. In the weeks that followed, sentiment remained heavily pressured, with the index slipping into historically low levels throughout November and December.

During that period, price action took a back seat to uncertainty. Risk perception dominated decision-making, and most participants opted for a wait-and-see approach rather than aggressive positioning.

Price Recovery Finds Support in Sentiment

That dynamic has begun to shift in recent days. As Bitcoin climbed back toward two-month highs, sentiment indicators followed. According to CoinGecko data, BTC rose from $89,799 to as high as $97,704 over the past week, with prices hovering around $96,414 at the time of writing.

What stands out is not just the price move, but the context around it. When Bitcoin last traded above $97,000 in mid-November, market sentiment was still firmly in “extreme fear” territory. Investors at the time largely viewed the rally as fragile and short-lived.

This time, price strength is accompanied by improving expectations — a subtle but meaningful shift.

A Telling Comparison With November

The contrast becomes clearer when looking back to November 14. Prices were at similar levels, yet sentiment was markedly different. Fear dominated, and concerns over further downside overshadowed any optimism.

Today, comparable price levels are being met with a constructive outlook rather than skepticism. That divergence suggests the market’s internal narrative has changed, even if conviction remains measured.

On-Chain Data Points to Controlled Optimism

Blockchain data reinforces this more nuanced picture. Santiment reports that over the past few days, 47,244 Bitcoin-holding wallets have exited the market — a sign that short-term retail participants may be reducing exposure amid lingering uncertainty.

At the same time, Bitcoin balances on exchanges have fallen to around 1.18 million BTC, the lowest level in seven months. Market participants often interpret declining exchange balances as a reduction in immediate selling pressure, since assets held in private wallets are less likely to be sold quickly.

Taken together, the data suggests a market that is stabilizing rather than overheating.

A Shift in Tone, Not a Rush to Euphoria

While sentiment has clearly improved, the broader picture remains restrained. Prices are rising, but behavior points to normalization rather than exuberance. Investors appear more comfortable taking exposure, yet remain selective and disciplined.

For now, the return of “greed” reflects a recalibration in expectations — not a full embrace of risk.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.