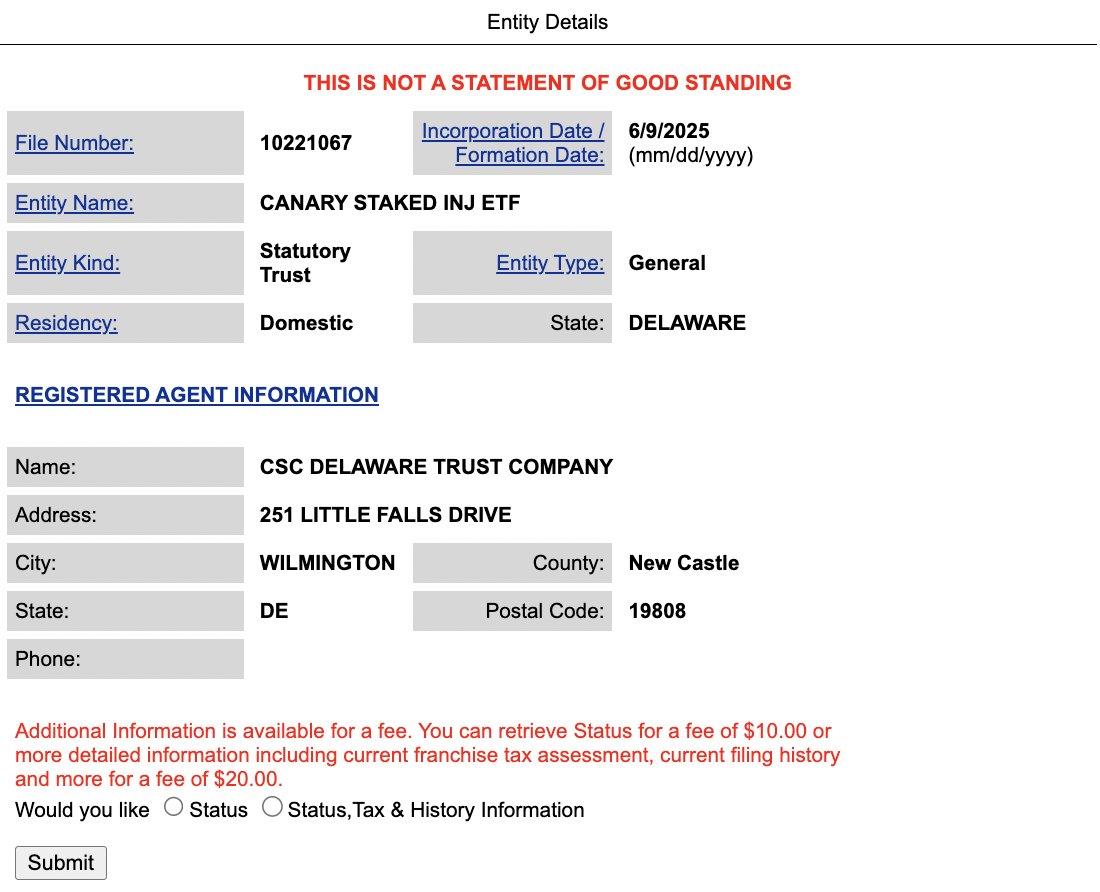

Canary Capital has submitted an official filing with the U.S. Securities and Exchange Commission (SEC) for a new exchange-traded fund (ETF) built around Injective (INJ), a fast-growing Layer-1 blockchain. The S-1 filing reveals that this ETF will offer investors direct exposure to staked INJ tokens, introducing a fresh product model that blends passive income potential with crypto asset exposure.

Growing Interest in Staking-Backed ETFs

The New York-based investment firm continues to push forward in the crypto ETF space, this time highlighting the rising demand for products centered around staking. According to the proposal, the fund will hold INJ tokens directly in its portfolio and allocate a portion of them to staking. However, specific details—such as the percentage of tokens that will be staked or the staking provider to be used—remain undisclosed at this stage.

This development aligns with a broader trend in which asset managers seek to combine the utility of decentralized networks with traditional financial structures. If approved, this would mark one of the first ETFs to offer direct staking exposure to a major altcoin, positioning it as an attractive option for both crypto-native and institutional investors seeking yield-based strategies.

Why Injective?

Injective is a purpose-built Layer-1 blockchain tailored for decentralized finance (DeFi) and financial application development. Its native token, INJ, serves a wide array of functions within the network, from governance to protocol-level utility. With a market capitalization of around $1.3 billion, INJ currently ranks among the top 100 digital assets globally, according to CoinGecko.

Injective’s growing ecosystem and developer adoption have turned it into a significant player in the smart contract space—particularly for applications involving derivatives, orderbooks, and high-speed financial protocols.

SEC Review Underway

The SEC has begun its standard review process, and a decision on whether the ETF will be approved is expected in the coming months. The outcome is being closely watched, as it could serve as a regulatory benchmark for staking-based investment vehicles in the United States.

A green light from regulators would not only validate Canary Capital’s strategy but also provide broader access to crypto yields through conventional brokerage accounts. The potential product could stand alongside Bitcoin and Ethereum ETFs, yet distinguish itself by offering access to staking rewards—a major value proposition for long-term investors seeking both growth and income.

Injective (INJ) Price Chart

Injective (INJ) is currently trading at $13.88, reflecting a 2.17% increase over the past 24 hours. This price movement is seen as both a reflection of the broader market recovery and a sign of growing investor interest following the recent ETF application.

The renewed demand for Layer-1 projects like Injective appears to be contributing to the upward momentum in INJ’s price.

You can freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.