Chainflip (FLIP) is a cross-chain protocol and Automated Market Maker (AMM) system that aims to revolutionize decentralized exchanges (DEX) by enabling seamless, low-slippage swaps between major blockchains.

The main goal of Chainflip is to allow users to swap native assets (e.g., ETH on Ethereum, BTC on Bitcoin) directly and permissionlessly, without relying on traditional bridges or wrapped tokens. This brings a “fire and forget” experience similar to centralized exchanges (CEX) for cross-chain swaps.

Project Concept

Chainflip addresses key issues faced by existing cross-chain solutions:

-

Bridge Risks and Complexity: Traditional bridges have security vulnerabilities and involve complex steps for users. Chainflip uses a “State Chain” and Just-in-Time (JIT) AMM mechanism to enable direct swaps across different chains.

-

Wrapped Asset Dependency: Many solutions require wrapped tokens (e.g., wBTC) to make assets interoperable across chains, creating extra risk and liquidity fragmentation. Chainflip allows native asset swaps.

-

High Slippage: Large cross-chain trades can suffer from high slippage. Chainflip’s JIT AMM allows liquidity providers (LPs) to supply liquidity only at swap time, minimizing slippage.

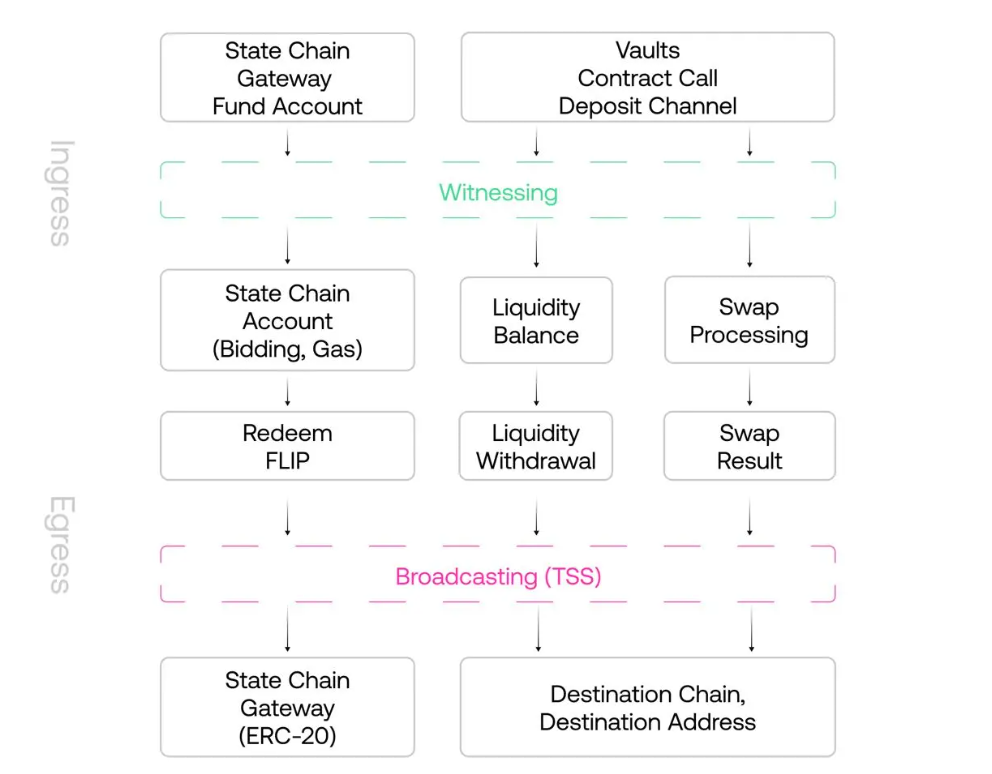

How the Protocol Works

Chainflip operates through three main components:

-

Chainflip State Chain:

Built on Substrate as a Proof-of-Stake (PoS) blockchain, it manages the state and consensus of cross-chain swaps. Validators monitor transactions on various chains (Bitcoin, Ethereum, Polkadot, etc.) and execute swaps securely. -

Just-in-Time (JIT) AMM:

Liquidity is not stored on the State Chain. Swaps use native assets in vault pools managed by validators. LPs compete to provide liquidity just before a swap, improving capital efficiency and ensuring the best price at the moment of the trade. -

Vault Pools:

Validators jointly control multi-signature or threshold signature (TSS) vaults holding native assets across supported chains.

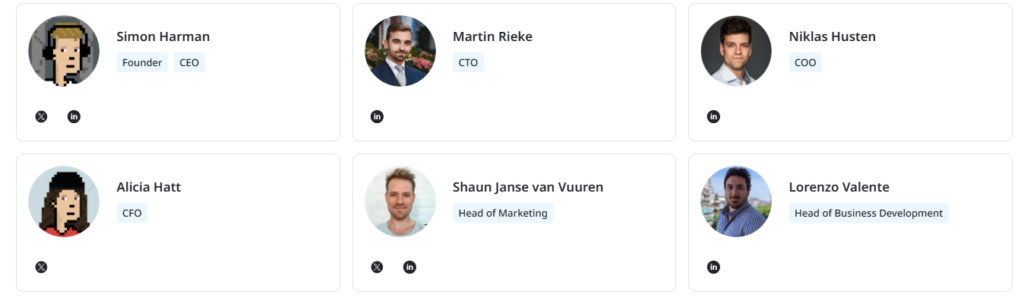

Team and Founders

Chainflip Labs is the main development entity behind the project.

-

Founder & CEO: Simon Harman, an experienced blockchain professional leading the project.

-

CTO: Martin Köppelmann, co-founder of Gnosis, providing technical leadership.

-

Lead Developers: Experts in Substrate and Rust development, maintaining an open-source and transparent workflow.

Investors and Partnerships

Chainflip has received support from major crypto funds and strategic players:

-

Framework Ventures

-

Pantera Capital

-

Coinbase Ventures

-

Draper Associates

-

Maven 11

Governance

Chainflip follows a decentralized governance model. FLIP token holders vote on protocol parameters. Validators secure the network and participate in consensus. Over time, governance decisions on fees, parameters, and upgrades will be delegated to the community.

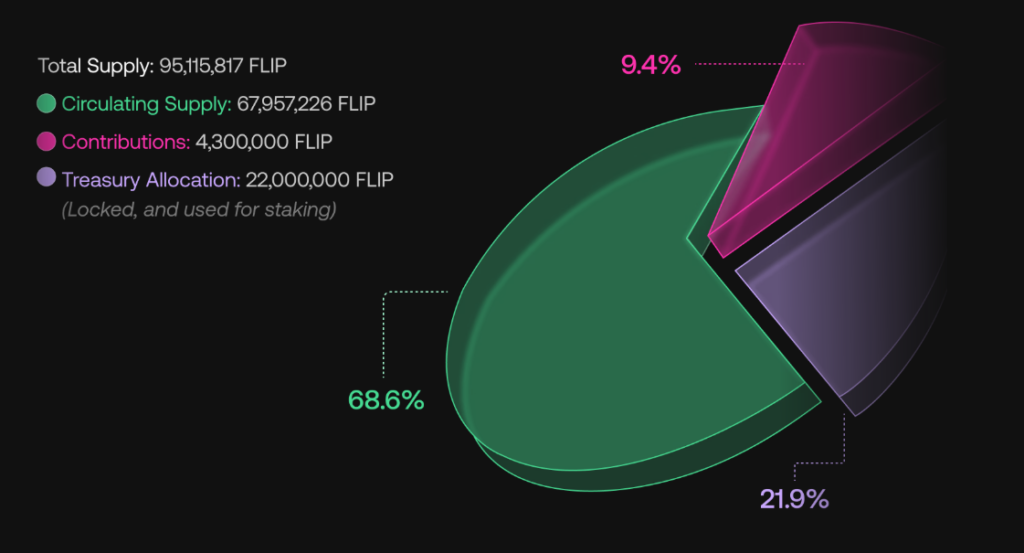

Token Information

The FLIP token is a multi-purpose utility and governance token that forms the foundation of Chainflip’s Proof-of-Stake (PoS) based State Chain.

-

Total Supply: 95,115,817 FLIP

-

Circulating Supply: 67,957,226 FLIP (~68.6% of total)

-

Treasury Allocation: 22,000,000 FLIP (~21.9%, locked for staking and network security)

-

Contributions: 4,300,000 FLIP (~9.4%)

Token Use Cases

-

Validator Staking: FLIP tokens are staked by validators to secure the network. Slashing applies for malicious behavior, while honest participation is rewarded.

-

Rewards & Fees: Validators earn swap fees and newly minted FLIP tokens (inflationary rewards).

-

Governance: FLIP holders vote on protocol upgrades and changes.

-

AMM Incentives: FLIP plays a role in JIT AMM, optimizing liquidity and swap incentives.

Ecosystem and Features

Chainflip aims to be a foundational DeFi layer:

-

Cross-Chain Swaps: Native swaps between Bitcoin, Ethereum, EVM-compatible chains, and popular L1/L2 networks without bridges.

-

Developer Tools: Enables complex Web3 products and cross-chain messaging solutions.

-

Liquidity Providers: JIT AMM incentivizes capital-efficient liquidity provision.

Core Features

-

Purpose: Direct swaps of native assets without bridges.

-

Technology: PoS State Chain coordinates secure cross-chain transactions.

-

Liquidity Model: JIT AMM minimizes slippage and maximizes capital efficiency.

-

Security: Secured by validators staking FLIP.

-

Token Utility: Staking, governance, and network fee participation.

-

User Experience: Simple, one-step swap similar to centralized exchanges.

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.