According to a Bloomberg report dated April 30, 2025, Ripple, a blockchain-based payment solutions provider, offered between $4 billion and $5 billion to acquire Circle, the issuer of the USDC stablecoin. Circle rejected the bid, deeming it “too low,” signaling confidence in its valuation and commitment to its planned initial public offering (IPO). Ripple’s move is seen as part of a broader strategy to strengthen its position in the competitive stablecoin market and expand its blockchain infrastructure.

Ripple’s Strategic Move

Ripple, known for its blockchain payment solutions, launched its own stablecoin, RLUSD, last year, which currently holds a market cap of $317 million. In contrast, Circle’s USDC, with a $62 billion market cap, ranks as the second-largest stablecoin globally. Sources cited by Bloomberg indicate that Ripple aimed to solidify its leadership in the stablecoin market and scale its blockchain infrastructure through the acquisition. Ripple CEO Brad Garlinghouse had previously hinted in March that the company might consider acquiring blockchain infrastructure firms.

READ: The US Department of Commerce Supports Bitcoin Mining!

Circle’s Rejection and IPO Plans

The company, however, chose to focus on its independent growth strategy, rejecting Ripple’s offer. The company filed for an IPO in the U.S. in April 2025. Macquarie analysts suggest that Circle’s IPO could mark a “turning point” for the crypto industry. With $1.68 billion in revenue in 2024 and 35% growth in USDC, Circle’s financial performance underscores why it viewed Ripple’s bid as insufficient. It aims to maintain its strong position in the stablecoin market while pursuing independent expansion.

As the issuer of over $32 billion in USDC, Circle holds the second-largest stablecoin market share. A successful acquisition by Ripple would have significantly bolstered its stablecoin presence, granting immediate access to a broad user base and regulatory connections.

Impact on the Crypto Sector

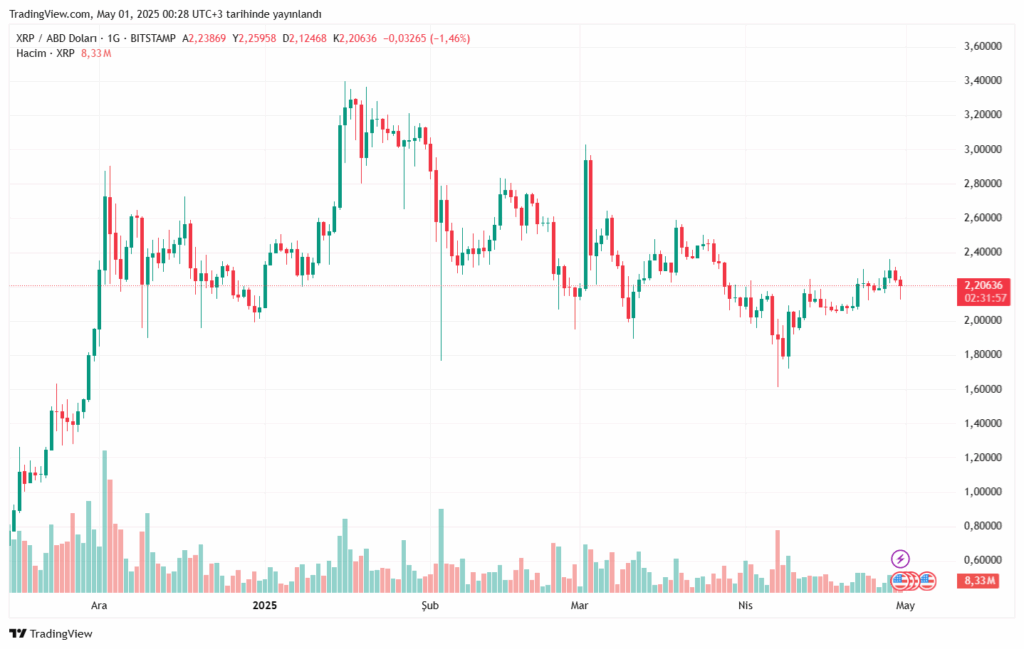

Ripple’s attempt to acquire Circle reflects ongoing consolidation trends in the crypto industry. Earlier this month, Ripple acquired Hidden Road for $1.25 billion, further signaling its aggressive growth strategy. Circle’s rejection suggests that stablecoin competition will intensify. Experts speculate that Ripple may return with a revised offer or pursue other acquisitions to fuel growth. Crypto investors are closely monitoring the potential impact of these developments on XRP and USDC prices.

The crypto market has been abuzz following Circle’s rejection of Ripple’s bid. Investors are debating how this will shape stablecoin competition. Some analysts predict that Circle’s IPO could boost USDC demand, while Ripple may strengthen XRP through additional acquisitions. On social media, particularly on the X platform, users are discussing how this move could alter the power dynamics in the crypto sector.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.