Hong Kong–based investment giant CMB International has officially launched the tokenized version of its CMB International USD Money Market Fund, valued at $3.8 billion, on the BNB Chain. This significant move is being seen as a prime example of the rapidly growing integration between traditional finance (TradFi) and blockchain-based financial infrastructure.

With this initiative, CMB International joins the ranks of major institutional players leading the tokenization of real-world assets (RWA) in digital ecosystems. The tokenization of the fund aims to enhance transparency, liquidity, and accessibility in global financial markets..

Fund Structure and Operation

The CMB International USD Money Market Fund primarily targets accredited investors. Participants can subscribe to or redeem shares of the fund using both fiat currencies and stablecoins. All transactions are supported by on-chain liquidity on the BNB Chain, ensuring full transparency and real-time settlement while significantly improving capital transfer efficiency.

In addition, the blockchain-based structure allows investors to benefit from lower transaction and payment costs, creating a more attractive investment environment for both individual and institutional investors.

BNB Chain Ecosystem Strengthens

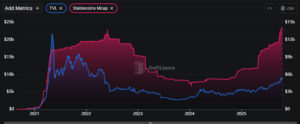

As Binance’s primary blockchain, BNB Chain has recently emerged as a major hub for the tokenization of real-world assets (RWAs). CMB International’s decision to launch on this network stems from BNB Chain’s advantages — including high transaction speed, low fees, and a robust security infrastructure.

Experts suggest that this partnership could boost on-chain transaction volumes within the BNB ecosystem and encourage more institutional players to explore decentralized finance (DeFi) opportunities. With initiatives like this, BNB Chain continues to move toward becoming the leading platform for tokenization across both DeFi and institutional finance.

Hong Kong: The New Hub of RWA Innovation

While mainland China continues to maintain strict regulations on cryptocurrencies, Hong Kong is rapidly emerging as a testing ground for innovative financial products. CMB International’s tokenized fund initiative further strengthens Hong Kong’s position as a regional hub for Real-World Asset (RWA) innovation.

This development not only boosts interest among Chinese institutions in blockchain-based financial applications but also indirectly reinforces confidence in the global cryptocurrency market. Experts emphasize that such institutional initiatives will accelerate the convergence of traditional finance and the crypto ecosystem.

Market Impact and BNB Token Analysis

In the short term, this development is seen as a positive signal for the BNB token. Growing institutional interest and new capital inflows could increase liquidity and capital movement within the BNB ecosystem.

However, analysts caution that global interest rate trends and macroeconomic factors could still influence the performance of money market funds and, by extension, affect the broader market dynamics surrounding BNB.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.