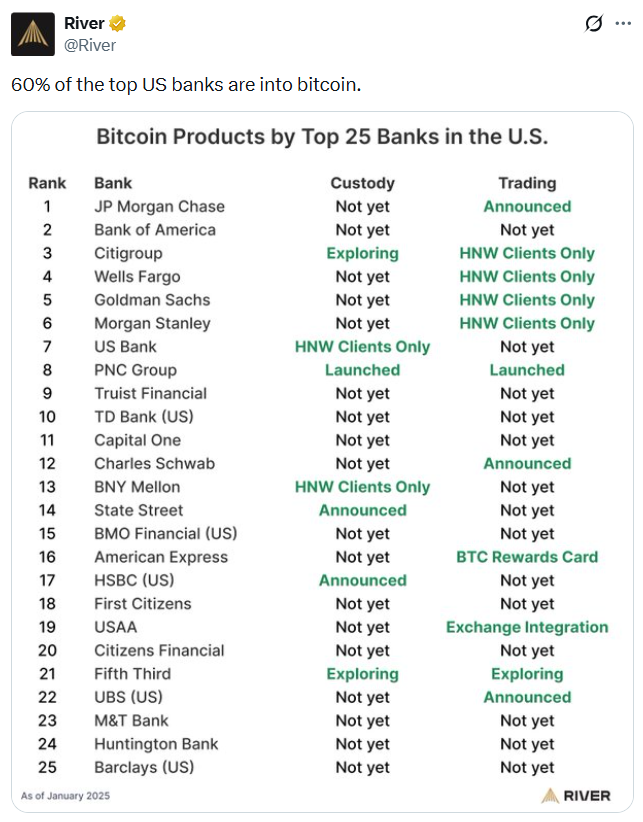

The stance of the U.S. banking sector toward Bitcoin has been undergoing a notable shift in recent months. Once viewed with skepticism, Bitcoin is increasingly being integrated into the strategic plans of traditional financial institutions. According to data shared by Bitcoin-focused financial services firm River, roughly 60% of the 25 largest banks operating in the United States have either begun offering Bitcoin-related services or publicly announced intentions to do so. This trend highlights a narrowing gap between legacy finance and the digital asset ecosystem.

Bank Executives Adopt a More Constructive View on Crypto

Coinbase CEO Brian Armstrong offered fresh insight into this transition following his participation in the World Economic Forum held in Davos. Armstrong noted that many of the banking executives he spoke with displayed a far more positive attitude toward cryptocurrencies than in previous years.

He explained that several senior banking leaders now see crypto not merely as an alternative investment class, but as a strategic necessity for the future of financial institutions. Armstrong shared that one CEO from a globally top-10 bank described crypto as their organization’s “number one priority,” even characterizing it as an existential issue. Such remarks suggest that digital assets are no longer viewed as optional experiments but as integral to long-term competitiveness.

Large Banks Expand Bitcoin-Related Offerings

This changing mindset is increasingly reflected in concrete actions. UBS, the Swiss banking giant with significant U.S. operations, was recently added to River’s list of Bitcoin-engaged institutions. The bank is reportedly evaluating the possibility of offering Bitcoin and Ether trading services to its wealthiest clients in the United States.

Among America’s so-called “Big Four” banks, momentum is also building. JPMorgan Chase has indicated that it is considering the addition of crypto trading services. Wells Fargo already provides Bitcoin-backed lending solutions for institutional clients, while Citigroup is exploring crypto custody services aimed at institutional investors. Together, these three banks manage more than $7.3 trillion in assets, underscoring the scale of capital now intersecting with Bitcoin.

Not All Institutions Are Fully On Board

Despite this progress, consensus across the banking sector remains incomplete. Bank of America, the second-largest bank in the U.S., has yet to announce any Bitcoin-related initiatives. Similarly, other major institutions such as Capital One and Truist Bank continue to maintain a cautious approach toward crypto services.

Banks are particularly hesitant when it comes to yield-generating stablecoin models, which many view as posing potential systemic risks. Until regulatory frameworks become clearer, most institutions appear unwilling to engage deeply with these products.

Overall, the broader picture suggests that Bitcoin is increasingly being recognized by U.S. banks as a durable component of the financial system rather than a passing trend. However, full-scale adoption across the sector is likely to remain a gradual process shaped by regulation, risk management, and market demand.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.