Corporate Bitcoin treasuries crossed a historic milestone this week. Between September 1 and September 6, companies added nearly 9,800 BTC. This inflow boosted total holdings above 1 million BTC, with a market value close to $1 billion.

New Bitcoin treasuries expand globally

Three new treasuries were launched during the period. A Dutch company secured 1,000 BTC through a $147 million funding round. Chinese-listed CIMG Inc entered with 500 BTC. US-based Hyperscale Data joined with an initial 3.6 BTC. Together, these firms accounted for 1,503 BTC.

Future commitments showed strong momentum. Canada’s Universal Digital announced a $100 million Bitcoin strategy in Japan through ReYuu. Japan’s Star Seeds pledged ¥1 billion ($6.8 million). In Australia, InFocus Group allocated AUD 2.5 million ($1.6 million) for a Bitcoin ETF. FiscalNote Holdings, Yoshiharu Global, and Sadot Group also revealed treasury preparation plans.

Existing companies accelerate Bitcoin purchases

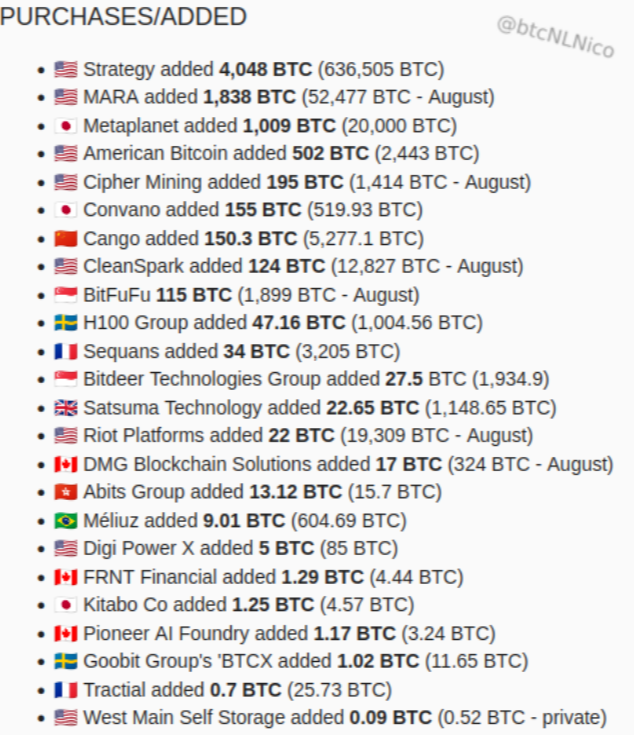

Michael Saylor’s Strategy led the week with a major purchase, taking its stash above 636,500 BTC. Marathon Digital added 1,838 BTC, while Metaplanet acquired 1,009 BTC and surpassed 20,000 BTC in total. American Bitcoin increased its treasury with 502 BTC.

Meanwhile, miners and firms added in smaller amounts. Cipher Mining bought 195 BTC, CleanSpark secured 124 BTC, Convano added 155 BTC, and Cango acquired 150 BTC. Sequans, Bitdeer Technologies, and DMG Blockchain Solutions made modest allocations. Altogether, 24 companies added 8,339 BTC during the week.

Future purchase approvals highlighted even larger sums. Metaplanet received approval for a ¥555 billion ($3.8 billion) raise. Japanese firm S-Science lifted its cap to ¥9.6 billion ($65.3 million). The UK’s Smarter Web Company struck a subscription deal worth £24 million ($32.4 million). Hyperscale Data announced a $20 million ATM-based Bitcoin plan, while Convano pledged ¥2.5 billion ($17 million).

Institutional participation is also widening. Sora Ventures launched a $1 billion Bitcoin treasury fund. American Bitcoin debuted on Nasdaq under the ticker $ABTC. DDC Enterprise expanded its treasury through Gemini, while Empery Digital executed a share repurchase to add Bitcoin. BlackRock recently purchased $290 million worth of BTC.

Corporate Bitcoin holdings have now exceeded 1 million BTC. This milestone reinforces Bitcoin’s role as a strategic reserve asset for global enterprises.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates