The cryptocurrency market closed the past week with relatively sideways movement in both Bitcoin and altcoins, while a very busy agenda awaits investors in the new week. Both global economic developments and important steps related to altcoin projects could lead to increased volatility across markets. Especially following security incidents focused on Flow (FLOW) and Trust Wallet, attention has shifted to the data releases and project developments scheduled for the coming days. Below, you can find a day-by-day overview of the economic calendar and altcoin events that crypto investors should closely monitor.

Monday, December 29

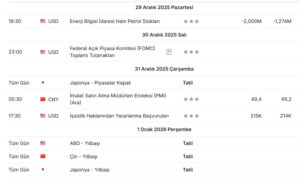

On the first day of the week, market attention will focus on topics closely related to the interaction between traditional finance and the crypto ecosystem. MSCI will begin collecting feedback from market participants regarding the planned index structure and eligibility criteria for Digital Asset Treasury (DAT) companies. This process is considered critical for Bitcoin-focused companies such as Strategy, and there is growing curiosity about how this index could affect the positioning of crypto companies among institutional investors. The final decision is expected to be announced on January 15.

On the same day, the token generation event (TGE) date for the LIT (Lighter) project will also be closely watched. The start of token supply stands out as a significant development that could create volatility, particularly for early investors and market participants tracking short-term price movements.

Tuesday, December 30

Tuesday features important developments on both the altcoin and macroeconomic fronts. PADRE platform token holders will become eligible to receive a certain amount of PUMP tokens following an acquisition carried out by PumpFun. This distribution could trigger short-term price movements in the related tokens. The most critical development of the day will be the release of the FOMC meeting minutes at 22:00. Signals regarding the U.S. Federal Reserve’s interest rate policy may have a direct impact on Bitcoin and altcoins.

Wednesday, December 31

On the final day of the year, several notable developments in the crypto sector will be in focus. Binance, one of the world’s largest cryptocurrency exchanges, announced that it will discontinue its Binance Live streaming service, marking a noteworthy change on the platform side. On the same day, Hats Finance, which operates in the decentralized securities space, announced its decision to terminate custody services. This move brings potential operational changes and transition processes to the agenda for project users.

On the macroeconomic front, the U.S. Initial Jobless Claims data, to be released at 16:30, will be closely monitored. This data provides important signals regarding the overall health of the U.S. economy and has the potential to affect global risk appetite and, indirectly, the prices of Bitcoin and altcoins.

Thursday, January 1

The first day of the new year will feature critical developments on the regulatory front. U.S. markets will be closed due to the New Year holiday. The Bank of Lithuania warned that crypto services without a MiCA license will be considered illegal as of January 1. In addition, the EU’s digital asset tax transparency law will come into force, making it mandatory for crypto service providers to report users’ transaction data. Hong Kong and the United Kingdom will also take important steps toward crypto regulations targeted for 2026.

Overall, the new week is set to be quite intense for the cryptocurrency market, both in terms of economic data and altcoin-focused developments. FOMC minutes, regulatory news, and token-related events could directly influence short-term price movements. Investors are advised to closely follow the calendar and take volatility risk into account during this period.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.