The sharp decline experienced in the cryptocurrency markets on October 10 triggered a widespread crash whose effects lasted for days. Binance, the world’s largest cryptocurrency exchange by trading volume and user count, released a new and comprehensive statement regarding the downturn. Binance argued that the crash was not caused by a platform-related failure, but rather by macroeconomic developments, market makers’ risk protocols, and congestion on the Ethereum network.

“The Decline Was Driven by Three Main Factors”

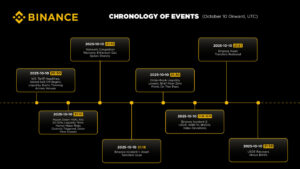

In its official statement titled “The October 10 Crypto Market Crash: What Really Happened and Binance’s Response,” Binance stated that the sharp market drop on October 10 was not the result of a single cause, but rather the simultaneous impact of three main factors. According to the exchange, these factors were global macroeconomic pressures, algorithmic risk control mechanisms used by market makers, and congestion on the Ethereum network. The statement emphasized that the combination of these elements weakened liquidity across the market and accelerated price movements to abnormal levels.

Binance also stressed that despite the severe shock experienced in the markets, the platform’s core systems continued to operate without interruption. The exchange specifically noted that there were no systemic failures, slowdowns, or trading halts in the matching engine, risk control systems, or settlement processes. Binance maintained that the volatility observed during this period stemmed entirely from extraordinary market conditions rather than any platform-related technical issues.

Trade War Headlines Triggered the Selling Wave

According to Binance, the resurgence of trade war headlines in global markets on October 10 accelerated risk-off sentiment among investors. As selling pressure intensified, extreme price movements activated market makers’ algorithmic risk protocols and circuit breaker mechanisms. While these systems aim to reduce inventory risk during periods of heightened volatility by automatically withdrawing liquidity, they led to a temporary but significant loss of liquidity in order books.

Citing data from Kaiko, the statement noted that Bitcoin liquidity on some exchanges fell to nearly zero within certain price ranges, making price declines far more severe than normal. Binance also highlighted that another critical factor deepening the market crash was congestion on the Ethereum network. During this period, gas fees reportedly exceeded 100 gwei at times, block confirmation times were significantly extended, and inter-exchange fund transfers slowed considerably.

In an environment where liquidity was already fragile, these technical disruptions further widened bid-ask spreads and caused even relatively small orders to have disproportionately large impacts on prices. According to Binance, these conditions resulted in a short-lived but highly impactful liquidity vacuum across the markets.

More Than $328 Million in Compensation Paid

Binance also shared details of two internal platform-related incidents that it stated were not the cause of the crash. A brief slowdown occurred in the transfer layer between Spot, Earn, and Futures wallets, while some users temporarily seeing their balances as “0” was attributed solely to a user interface (UI) issue. The exchange announced that as of October 22, 2025, more than $328 million in compensation had been paid to eligible users affected by these two incidents. Additionally, Binance reiterated that it had established a $300 million goodwill program for retail users and a $100 million low-interest loan fund for institutional users.

Binance’s statements indicate that the October 10 crypto market crash was driven not by a platform-related technical failure, but by a combination of macroeconomic shocks, liquidity withdrawal, and congestion on the Ethereum network. The incident once again highlights how quickly high leverage and liquidity risks in crypto derivatives markets can evolve into systemic impacts.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.