Crypto fund outflows slowed significantly last week, totaling just USD 187 million. Price pressure is still present, but the slowdown in investor behavior may historically signal that the market is approaching a bottom. During a week when Bitcoin dropped to USD 60,000, outflows were limited to just USD 264 million, which drew attention.

According to CoinShares data, the decrease in fund flow speed may indicate a market bottom and a turning point in investor sentiment. Interestingly, while everyone is focused on Bitcoin, some altcoins remain attractive.

Fund Outflows Slow, XRP Leads

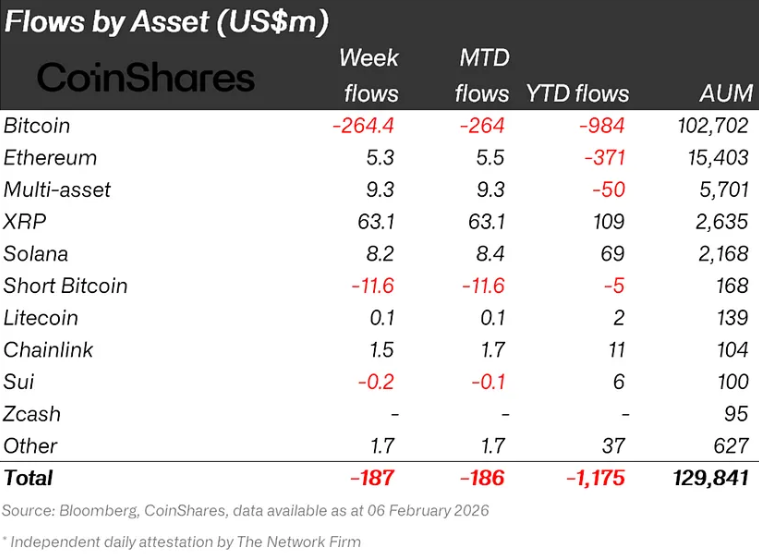

Last week’s total outflow was USD 187 million. Yes, outflows are still happening, but the pace has clearly slowed. Over the previous two weeks, total outflows reached USD 3.5 billion, meaning investors remained cautious despite last week’s declines.

Bitcoin sentiment remains bearish, while XRP continues to be the focal point for investors. Last week, XRP saw inflows of USD 63.1 million, bringing its year-to-date total to USD 109 million, making it the most successful digital asset. Solana and Ethereum followed with USD 8.2 million and USD 5.3 million in inflows, respectively. Bitcoin, meanwhile, saw USD 264 million in outflows, showing that investor caution continues.

ETP Trading Volume Hits Record

Total assets under management fell to USD 129.8 billion, the lowest since March 2025. Funds under management also decreased to USD 19.8 billion, marking the lowest level since March 2025. However, ETP trading volume reached a record USD 63.1 billion, surpassing the previous high of USD 56.4 billion in October. On one hand, price pressure persists; on the other hand, trading activity is extremely high. This suggests that investors remain active, possibly taking shorter-term, more flexible positions.

Regional and Altcoin Divergence

Regionally, Germany saw strong inflows of USD 87.1 million, followed by Switzerland with USD 30.1 million, Canada with USD 21.4 million, and Brazil with USD 16.7 million. While Bitcoin outflows continued, altcoins such as XRP, Solana, and Ethereum attracted renewed investor interest. Not all regions and assets move in sync; a mild divergence exists, and it’s not enough to just look at the numbers.

Overall, crypto fund outflows are slowing, and certain altcoins continue to attract investor interest. This suggests a potential market bottom is forming, though small fluctuations and interim moves still pose risks.

Also, in the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube and Twitter for the latest news and updates.