Last week, crypto inflows surged to $578 million, triggering an upward trend. The main driver behind this increase was Trump’s decision to allow crypto assets in the US 401(k) retirement plans. Following a $223 million inflow the previous week, this development created significant momentum in the markets.

Trump’s decision caused outflows seen midweek to quickly reverse into inflows. According to the CoinShares report, investors initially made $1 billion in crypto outflows earlier in the week. However, the government’s green light for cryptocurrencies balanced these outflows with $1.57 billion inflows. As a result, the net inflow reached $578 million.

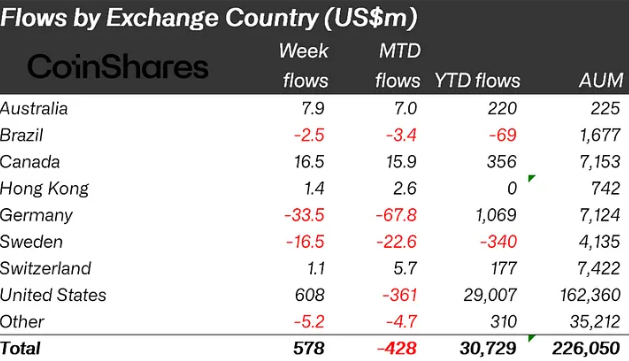

The US recorded the highest crypto inflows last week. James Butterfill, Head of Research at CoinShares, stated that markets gained positive momentum after digital assets were allowed in 401(k) plans. On the other hand, crypto ETF volumes declined by 23% compared to last month due to the usual summer slowdown.

Shifting Balance Between Bitcoin and Ethereum Investments

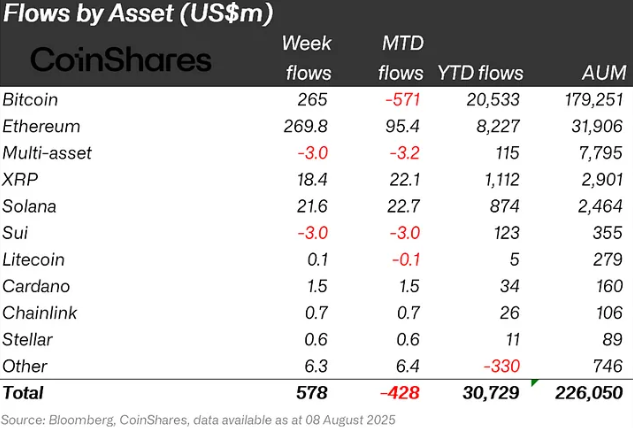

Ethereum had long been the leader in the altcoin market. In recent weeks, Ethereum investment products saw record inflows of around $4.39 billion. The previous week, Ethereum received $133.9 million while Bitcoin investments experienced a $404 million outflow. However, this picture has changed in recent weeks.

Bitcoin showed recovery signs after two consecutive weeks of outflows, rapidly closing the gap with Ethereum. Samson Mow, CEO of Jan3, notes that most Ethereum investors originally held significant Bitcoin during the ICO period and converted their Bitcoin to Ethereum to support Ethereum’s price.

According to Butterfill, Bitcoin’s recovery supports the positive market sentiment. The balance between these two major crypto assets indicates strengthening investor confidence. Additionally, Trump’s 401(k) move helped sustain this optimism.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.