Total crypto market capitalization fell to $2.93 trillion, marking its lowest level since April and wiping out all yearly gains. Analysts expect further short-term declines.

According to CoinGecko, the total market cap dropped to $2.93 trillion in late trading on Thursday. Since early October, when the market reached an all-time high of around $4.4 trillion, total capitalization has fallen roughly 33% and is down nearly 14% year-to-date. This decline has led many analysts and observers to declare that the bear market has begun.

The market had previously dropped to $2.5 trillion on April 9, 2025, before climbing to all-time highs six months later. Since March 2024, the market had largely traded sideways and has now returned to the middle of that range.

Bank of Japan Hikes Rates

Michaël van de Poppe, co-founder of MN Fund, said on Friday that more short-term pain is likely and the downward trend may continue until the Bank of Japan makes its interest rate decision. Japan’s central bank raised rates to 0.75% Friday morning. While some analysts said this could be negative for crypto, Bitcoin BTC $87,165 rose by 2.3%.

Van de Poppe said: “I wouldn’t be surprised if BTC continues to cascade and enters a form of capitulation in the next 24 hours. This would imply a 10-20% drop in altcoins, which should then bounce quickly.”

Social Sentiment at Rock Bottom

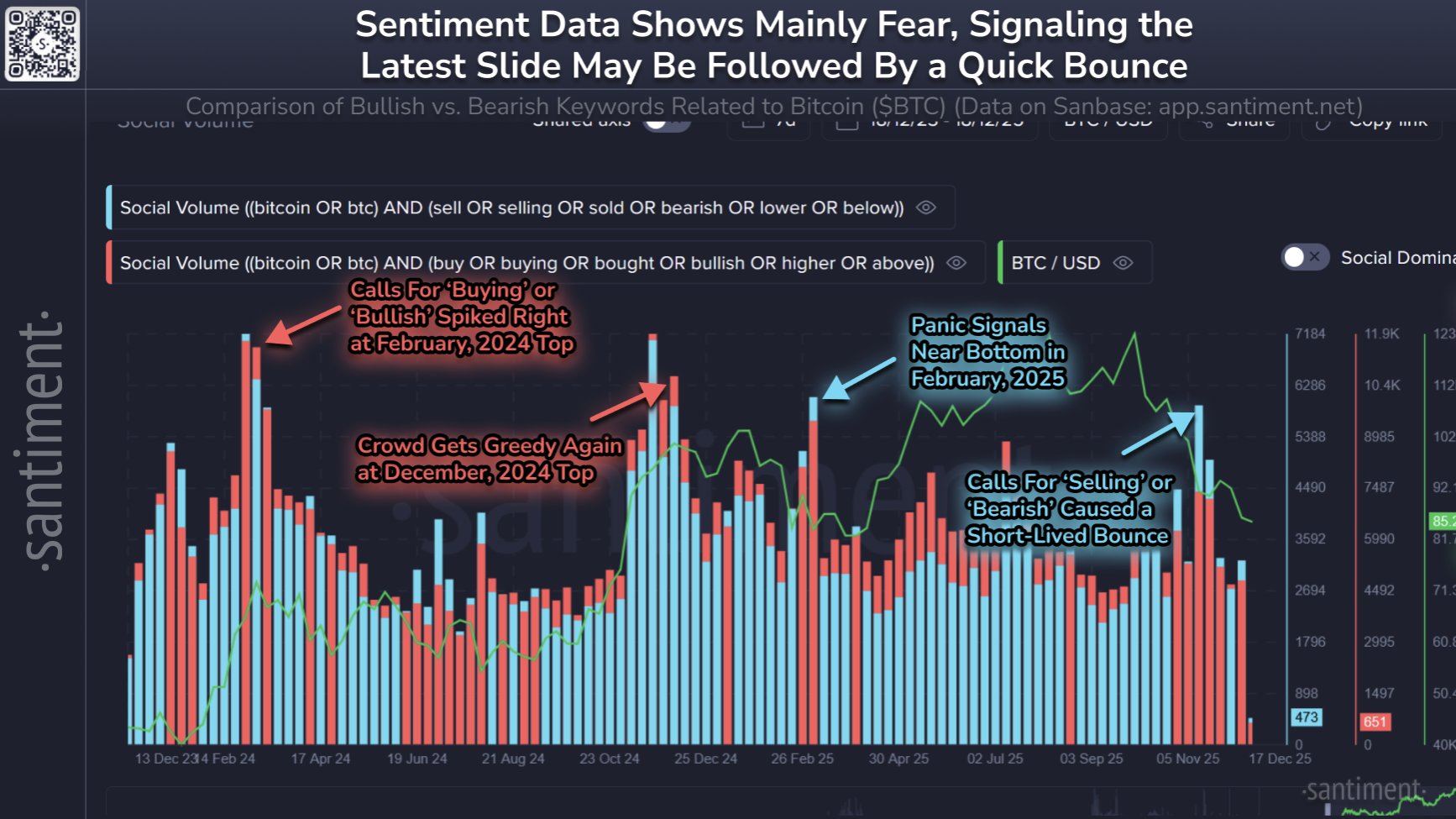

Blockchain analytics platform Santiment reported that crypto sentiment is back at fear levels following a minor pump-and-dump on Thursday.

“Bitcoin bounced to $90.2K yesterday and quickly retraced to $84.8K. Commentary mainly shows fear. Bearish mentions, especially #selling, #sold, #bearish, or #lower, are notably higher across X, Reddit, and Telegram. Historically, when retail pushes the bearish narrative harder than bullish, prices often move opposite to the crowd. This fear-marked volatility is a strong signal for those patient enough to ride it out,” Santiment noted.

“Prices moving opposite to crowd expectations and volatility marked by fear are a good signal for patient investors.”

Meanwhile, the Crypto Fear & Greed Index is at 16, signaling “extreme fear,” and has remained below 30, in “fear” territory, since early November.

Why It Matters

The crypto market returning to an 8-month low highlights declining investor risk appetite and the impact of macroeconomic pressures. Social sentiment dominated by fear signals potential short-term buying opportunities while providing crucial insight for institutional strategy.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.