The crypto market is gaining momentum again today. Global valuation has increased by more than 3%, and the total market is trading at 3.11 trillion dollars. After prolonged pressure, the market is starting to recover. As prices move higher, investor behavior, macro conditions, and ETF flows signal a strong reversal.

Macro Improvement Strengthens the Market

Bitcoin climbed above the 90,000 level during the day, increasing buying appetite. Ethereum rose 3% and surpassed 3,000 dollars, forming a positive price action ahead of the December 3 Fusaka upgrade. Solana gained 4%, BNB rose 5%, while Cardano held above 0.15 dollars. XRP’s 2% increase supported the overall market recovery. The broad-based rise in altcoins strengthened confidence.

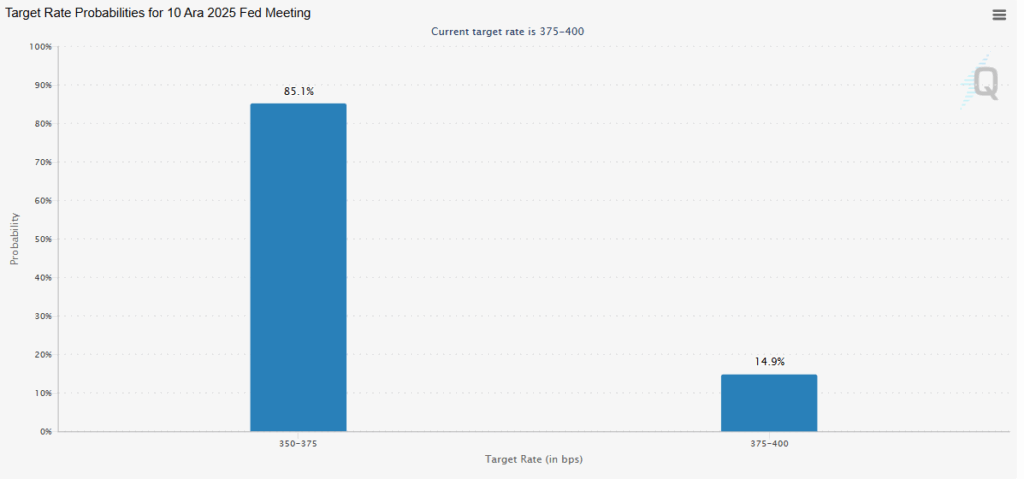

The improvement gained speed with expectations that the Fed could cut interest rates. Slowing inflation and a cooling labor market pushed the probability of a December rate cut to 85%. This environment boosted risk appetite. The movement in tech stocks carried momentum into digital assets. Investors, seeing recession risks weaken, took more aggressive positions. This behavior supported crypto and strengthened the upward setup.

The drop in weekly U.S. jobless claims to a seven-month low became one of the strongest signals shaping market direction. This decline suggested a soft landing rather than a sharp slowdown. Investors interpreted this as a reassuring sign, accelerating the shift into risk assets. This behavior directly reflected on the crypto market.

ETF Developments Boost Demand

Anticipated spot ETF processes for Ethereum, Bitcoin, XRP, DOGE, and Solana injected new energy into the market. Bitwise’s Avalanche ETF announcement strengthened the positive atmosphere. On November 26, Ethereum spot ETFs recorded four consecutive days of inflows totaling 60.82 million dollars. Bitcoin products saw 21.12 million dollars in net inflows, while Fidelity’s fund declined. XRP products recorded 21.81 million dollars in inflows. Although Solana ETFs saw an outflow of 8.1 million dollars, overall demand remained strong.

The rapid decline in Bitcoin funding rates provided an additional signal for the market. As rates stay in negative territory, the outlook becomes more positive. Negative funding shows that traders who doubt the rally are opening short positions. As price rises, this creates liquidity pressure on shorts. Since markets often move against expectations, this structure becomes a mechanism supporting the upward trend.

Kaspa rose 20%, while SPX and Flare gained 12%. Buying behavior strengthened and the upward trend spread across the market. Macro conditions, capital flows, and investor psychology worked together to support the market’s renewed recovery.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.