Crypto market volatility shows investors’ confidence in a September Fed rate cut is weakening. Recent FOMC minutes revealed most members view inflation risks as heavier than the labor market weakness. U.S. PPI rose 0.9% in July, pushing core PPI to 3.7%. Meanwhile, institutions and investors lost confidence in a Fed rate cut this September.

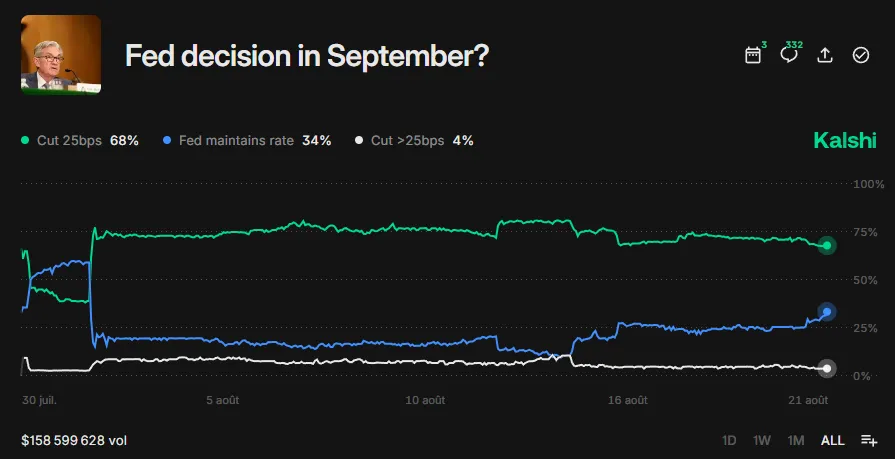

Prediction markets like Kalshi indicate declining bets on a 25-basis-point rate cut while wagers on unchanged rates are increasing. Currently, 68% of investors expect a 25-basis-point cut in September, though this share is decreasing. Conversely, 34% predict no change in Fed rates. This trend adds uncertainty to the markets.

CME FedWatch shows a 79% chance for a 25-basis-point cut in September. Down from 99%, investors now expect two rate cuts this year instead of three. This shift encourages more cautious market behavior and delays investment decisions.

Investors Await PCE Data While Bitcoin Holds Support

Crypto investors closely monitor the Fed’s preferred inflation gauge, PCE data. In June, U.S. PCE inflation rose 2.6% year-over-year, exceeding May’s upwardly revised 2.4% estimate. These figures will be crucial for the Fed’s September decisions, with results scheduled for August 29.

Bitcoin finds support near $112,000, and analysts suggest buying on dips. Michael van de Poppe notes that BTC follows classical price movements. He recommends accumulating if prices fall below $110,000. Rekt Capital recalls Bitcoin fell 29% in 2017 and 25% in 2021. Over the last 24 hours, BTC dropped 0.31% to $112,892. Trading volume fell 10%, signaling reduced investor interest.

This uncertainty and volatility affect global markets and encourage cautious investor behavior. All eyes remain on the August 29 PCE release. Fed Chair Powell’s Jackson Hole speech and rising U.S. 10-year Treasury yields, alongside the DXY dollar index hitting 98.34, continue to influence market dynamics.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.