Taiwan’s publicly listed first corporate Bitcoin treasury, Top Win International, has taken a significant step toward its Bitcoin accumulation goal. The company announced a $10 million capital raise to accelerate BTC purchases.

The funding round was led by zipper manufacturer and software company WiseLink, along with four other private investors, including Chad Koehn, founder and CEO of United Capital Management of Kansas.

Convertible Bond Investment

WiseLink purchased three-year convertible bonds issued by Top Win. This investment is seen as a precursor to an as-yet-unannounced strategic collaboration between the two companies.

According to the company, the majority of the raised funds will be used to directly acquire Bitcoin. Additionally, Top Win plans not only to buy BTC but also to invest in publicly traded Bitcoin treasury companies.

To clarify its strategy and avoid the perception of being a “securities trading company,” Top Win stated:

“Our goal is not to trade securities but to pursue a long-term Bitcoin-focused treasury strategy.”

Luxury Watchmaker Shifts to Bitcoin Strategy

Taiwan-based luxury watchmaker Top Win International announced in May 2025 that it had transitioned to a Bitcoin treasury strategy. This shift followed a collaboration with Sora Ventures, which partnered with Metaplanet—the company that established Japan’s first corporate Bitcoin treasury in 2024.

The company even hinted at renaming itself to AsiaStrategy as a nod to MicroStrategy’s Bitcoin strategy, though official communications continue to use the “Top Win International” name.

Strong Leadership Team

During this transition, Jason Fang, founder and managing partner of Sora Ventures, joined Top Win’s board and assumed co-CEO duties alongside the existing CEO.

Stock Price Volatility

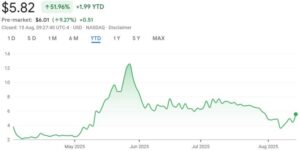

The capital raise announcement was positively received by the market on Friday. Top Win International’s shares rose approximately 13% in pre-market trading, reaching $5.82.

However, on the day in May when the BTC strategy was announced, the share price had reached $12.12. While today’s price represents a roughly 51% decline from that peak, the stock has still gained 52% year-to-date.

However, on the day in May when the BTC strategy was announced, the share price had reached $12.12. While today’s price represents a roughly 51% decline from that peak, the stock has still gained 52% year-to-date.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.