Crypto trading volume fell sharply in November, hitting a six-month low at $1.6 trillion. The crypto market cooled rapidly after October’s intense activity and signaled a clear shift in investor behavior. The slowdown affected both centralized exchanges and decentralized platforms.

Centralized exchanges saw a steep decline

Centralized exchanges recorded $1.59 trillion in spot trading during November, marking a significant drop from the previous month. This decline followed fading volatility and widespread profit-taking after October’s rapid rally. As trading ranges narrowed, short-term opportunities weakened and traders reduced exposure.

Binance remained the largest exchange with $599 billion in volume, although the figure reflected a sharp pullback from October. Bybit, Gate.io and Coinbase also posted declines, reinforcing the broader cooling trend across the sector. The crypto market entered a slower phase as reduced momentum limited risk appetite and curbed trading frequency.

This period highlighted a notable shift in trading behavior, as investors responded to compressed conditions and waited for clearer market signals.

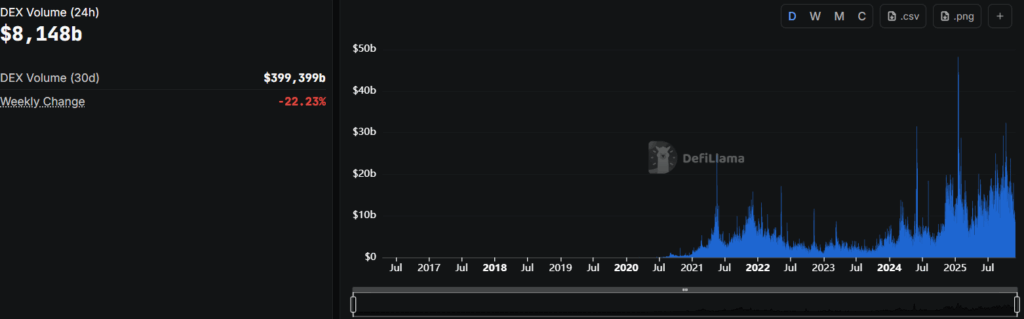

DEX volume also dropped significantly

The slowdown extended to decentralized exchanges. DEX volume fell to $397.7 billion in November, marking the lowest level since June. Additionally, major platforms like Uniswap and PancakeSwap saw meaningful decreases, reflecting softer DeFi incentives and weaker speculative activity. The market slowdown and narrower price ranges further reduced short-term trading participation.

The DEX-to-CEX volume ratio slipped to 15.73 percent, signaling a rotation back toward centralized exchanges. Deeper liquidity and tighter spreads provided more efficient execution, which became increasingly important as volatility dried up. Meanwhile, reduced incentive yields made DEX activity less attractive in the short term.

Bitcoin’s price drop weakened overall risk appetite

The downturn became more visible through Bitcoin price action. The Bitcoin price fell from $110,000 to nearly $81,000 over the month, adding pressure to the broader market slowdown. Combined with shrinking trading activity, the drop reinforced caution among retail and institutional traders. Spot Bitcoin ETFs recorded $3.48 billion in net outflows, the highest since February.

These developments shaped three key behavioral shifts in November:

• Traders preferred waiting as volatility collapsed.

• Low-margin trading reduced overall activity.

• Liquidity tightened across both CEX and DEX platforms.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.