Recent losses across the crypto market suggest that the current downturn is unfolding far more aggressively than past bear cycles. Analysts note that Bitcoin has entered this bearish phase with unusual speed and intensity, raising questions about how this cycle differs structurally from earlier corrections. On-chain data indicates that momentum has deteriorated faster than it did during the 2022 bear market, pointing to a sharper and more compressed drawdown.

A Steeper Drop Compared to 2022

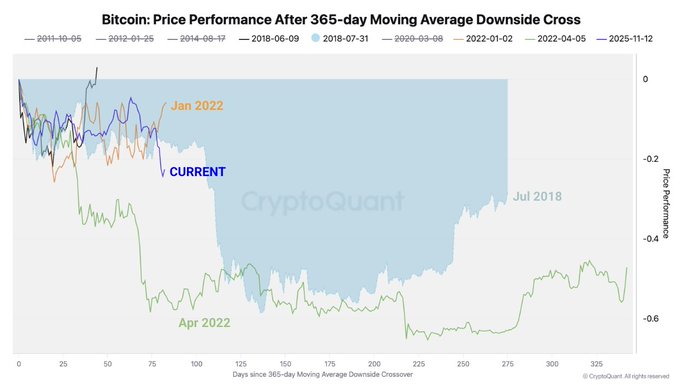

According to on-chain analytics from CryptoQuant, Bitcoin slipped below its 365-day moving average in November and has since declined by roughly 23% in just 83 days. By contrast, during the early phase of the 2022 bear market, Bitcoin lost only about 6% over a comparable period. This divergence highlights how quickly selling pressure has accelerated in the current cycle.

CryptoQuant characterizes this performance as weaker than the opening phase of the previous bear market, suggesting that downside momentum is building at a faster pace than investors have seen in recent history.

Structural Weakness Becoming More Visible

Bitcoin reached an all-time high of $126,000 in early October, at a time when the Bull Score Index stood at a robust 80. However, following a major liquidation event on October 10, market conditions shifted abruptly. The Bull Score Index flipped into bearish territory and has since fallen to zero, while Bitcoin’s price dropped toward the $71,000 level.

Analysts interpret this combination as a sign of broad structural weakness. Several key support levels have been lost, increasing the likelihood that Bitcoin could drift into the $70,000–$60,000 range. Additionally, BTC has been rejected three times at the “Traders’ On-chain Realized Price,” an important support and resistance metric. More recently, price action slipped below the lower band of this indicator, which had previously acted as a floor during the bull phase.

Extreme Bearish Sentiment Across the Market

Market sentiment has deteriorated sharply. Data from Santiment shows that investor outlook toward both Bitcoin and Ethereum has turned deeply negative following the latest selloff. At the same time, Santiment notes that extreme retail pessimism can sometimes set the stage for short-term relief rallies, as markets often move against prevailing sentiment.

Glassnode paints a similarly cautious picture, describing a bear market marked by rising realized losses, weak spot demand, and the unwinding of leverage. The Crypto Fear and Greed Index has fallen to around 12, reflecting widespread panic and risk aversion.

Broader Market Impact

Total crypto market capitalization has declined by 4.4% to approximately $2.53 trillion, the lowest level since April 2025. Bitcoin briefly fell below $71,000 during Asian trading hours, with analysts now watching the $65,000 region as the next major support. Ethereum has dropped under $2,100 and failed to stage a meaningful recovery, while most altcoins are trading roughly 80% below their peak levels.

Overall, the data suggests that this Bitcoin downturn stands out for its speed, severity, and structural fragility, with volatility likely to remain elevated in the near term.

This content is for informational purposes only and does not constitute investment advice.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.