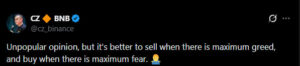

As the crypto market begins recovering from one of the sharpest sentiment breakdowns seen in recent weeks, Binance founder Changpeng Zhao (CZ) issued a noteworthy warning to investors regarding market psychology. Posting on X, CZ reminded followers of one of crypto’s fundamental investment principles:

“An unpopular opinion, but it’s better to sell when there is maximum greed and buy when there is the highest fear.”

Although this strategy is a classic within the crypto community, the timing of CZ’s remark—during a period when the market had been stuck in the Extreme Fear zone for 18 consecutive days—drew significant attention. During such emotionally volatile phases, investors often struggle to act rationally. Thus, CZ’s message serves not just as simple investment advice, but as a reminder tailored to the current psychological state of the market.

Crypto Fear & Greed Index Exits Extreme Fear

The Crypto Fear & Greed Index, which tracks general investor sentiment across the crypto market, rose to 28 on Saturday, exiting the “Extreme Fear” zone for the first time since November 10. The index had fallen to 10 on November 22 — its lowest reading of the year. Analysts described this period as unusually severe:

- Matthew Hyland noted that the index had reached the cycle’s “most extreme fear level.”

- Crypto Seth commented that “Extreme Fear remains mild,” highlighting ongoing tension in the market.

- Trader Nicola Duke pointed to a key historical pattern: “Over the past five years, every time the index dropped into Extreme Fear, Bitcoin formed a local bottom within weeks.”

These insights suggest the market may be near bottom levels — but they also reveal that investor psychology remains fragile.

Bitcoin Holds Above $90,000, Signaling Tentative Stability

At the time of writing, Bitcoin is trading around $90,800. This level indicates a partial recovery following last week’s sharp volatility. However, analysts emphasize that investor confidence is still very weak.

- Santiment data shows that social discussions around Bitcoin are focused less on excitement and more on volatility and institutional flows.

- The Altcoin Season Index sits at 22/100, confirming that the market remains in a “Bitcoin Season,” indicative of low risk appetite.

- André Dragosch, Head of Research at Bitwise Europe, highlighted that Bitcoin is currently pricing in expectations of a global economic slowdown.

Together, these indicators show that market sentiment, while improving, is still delicate.

Why CZ’s Warning Comes at a Critical Time

In the midst of this uncertainty, CZ’s reminder to “buy during fear” strikes at the psychological heart of the current market cycle. Analysts note that such comments often appear around market bottom zones, aligning with classic behavioral patterns.

Although the crypto market has technically exited Extreme Fear, sentiment remains sensitive. CZ’s message serves as a strategic warning urging investors to avoid being swayed by emotional swings and instead keep focus on the broader picture.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.