Investor sentiment in the U.S. crypto markets continues to fluctuate. Bitcoin and Ethereum spot ETFs faced a cautious stance from institutional investors during the latest trading session. Analysts suggest that this volatility stems from short-term profit-taking and uncertainty over the market’s direction.

In recent weeks, spot crypto ETFs listed on U.S. exchanges have shown a noticeable slowdown in investor activity, driven by rising volatility. Demand for Bitcoin- and Ether-focused funds has weakened, especially in recent days, as institutional investors adopt a more risk-averse approach. Growing interest rate concerns and geopolitical tensions have also prompted investors to reassess their digital asset positions.

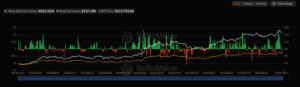

Millions Flow Out of Bitcoin Spot ETFs

Overall, Bitcoin ETFs ended the day with $326.52 million in net outflows. Fund managers attribute this movement to short-term investors taking profits. The sell-offs coincided with Bitcoin’s recent sideways movement around the $60,000 level. Analysts emphasize that these outflows do not disrupt the long-term investor trend rather, they signal a maturing market where investors are becoming more disciplined and strategic in their positioning.

Weak Demand Signals in Ether Spot ETFs

Ethereum ETFs faced a similar wave of heavy selling, recording $428.52 million in outflows by the end of the day. This development is largely attributed to Ethereum’s weaker performance against Bitcoin in recent weeks. BlackRock’s Strategic Resilience On a trading day marked by intense sell-offs, BlackRock stood out from other ETF issuers by remaining in positive territory. The company’s iShares Bitcoin Trust (IBIT) fund ended the day with $60 million in net inflows.

Experts attribute BlackRock’s resilience to its cost-efficient institutional access and trusted ETF structure, which continue to attract professional investors even amid market volatility.

Short-Term Volatility in the Crypto ETF Market

While the U.S. crypto ETF market remains volatile in the short term, long-term investor interest persists. BlackRock’s strong performance underscores institutional confidence in digital assets. Analysts predict that Bitcoin and Ethereum ETFs could see renewed inflows in the coming period as market conditions stabilize.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.