The crypto market has been hit by a wave of intense selling pressure in recent hours. Bitcoin’s rapid decline, which erased all of its gains accumulated throughout 2025, has pushed the asset into what many consider “bear market territory.” This sudden reversal has raised serious concerns among investors. But what is driving the downturn, and how do experts interpret the situation?

Bitcoin Wipes Out 2025 Gains as Liquidations Surge

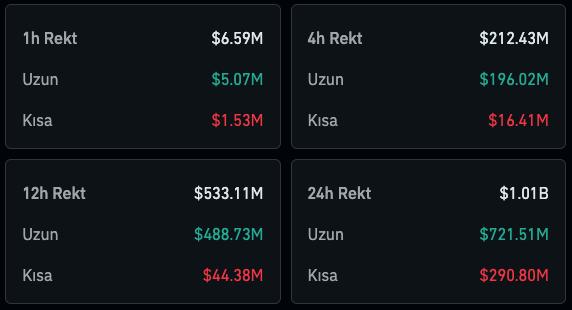

Bitcoin’s sharp pullback triggered more than $1.1 billion in liquidations across major exchanges, creating a chain reaction of forced selling. In addition to this widespread liquidation event, digital asset investment products experienced approximately $2 billion in outflows, adding further weight to the sell-side pressure. Therefore, questions came to mind whether the bear market has started.

This dramatic market move quickly became a focal point of a recent discussion hosted on the YouTube channel “The Wolf Of All Streets,” where macro strategists dissected the rapid volatility. Many analysts noted that the pattern of cascading liquidations and fear-driven selling resembles previous market collapses in crypto history.

McGlone Warns: A Modern “Black Monday” Cannot Be Ruled Out

Bloomberg Senior Commodity Strategist Mike McGlone issued a stark warning about the potential implications of the current decline. According to McGlone, the sell-off is not merely a short-term correction but could signal the early phase of a deeper downturn—possibly extending beyond crypto and impacting equities as well. He cautioned that the risk of a modern-day “Black Monday” scenario is increasingly worth considering.

Experts participating in the discussion highlighted several key drivers behind the negative market sentiment:

- Weakening Capital Inflows: A decline in fresh capital entering the market has reduced Bitcoin’s ability to recover from sharp moves.

- Mounting Macro Pressures: Global economic uncertainty, shifting central bank policies, and recession risks continue to weigh on risk assets.

- Stress in Derivatives Markets: Panic in futures and options markets is spilling over into spot trading, amplifying volatility.

- Insider Selling in Tech Stocks: Heavy insider selling among major technology firms is further eroding investor confidence.

Are We at the Beginning of a Bear Market?

McGlone argues that Bitcoin’s recent drop should not be interpreted as a temporary dip. Instead, he believes the market is entering a structurally bearish phase. Unless broader macroeconomic conditions improve, Bitcoin may continue leading the downside, potentially dragging the rest of the crypto market with it.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.