Dill is a next-generation Layer 1 (L1) blockchain designed to maximize decentralization and provide limitless scalability. Built on modular and sharding technologies, Dill is designed to be five years ahead of Ethereum’s roadmap. Its architecture optimizes execution and data layers, offering unique scalability while maintaining high security and decentralization.

Innovative two-tier staking and mini-pool technology enable a decentralized validator set with low entry barriers. With a capacity of 1 million validators, Dill supports mass adoption of dApps. The network delivers 800,000+ transactions per second (TPS) and 20 MB/s data throughput on standard hardware.

Team and Founders

Dill’s team consists of experts in blockchain development and distributed systems. The founders prioritize decentralization and high performance. Validators and partner nodes ensure network security and scalability.

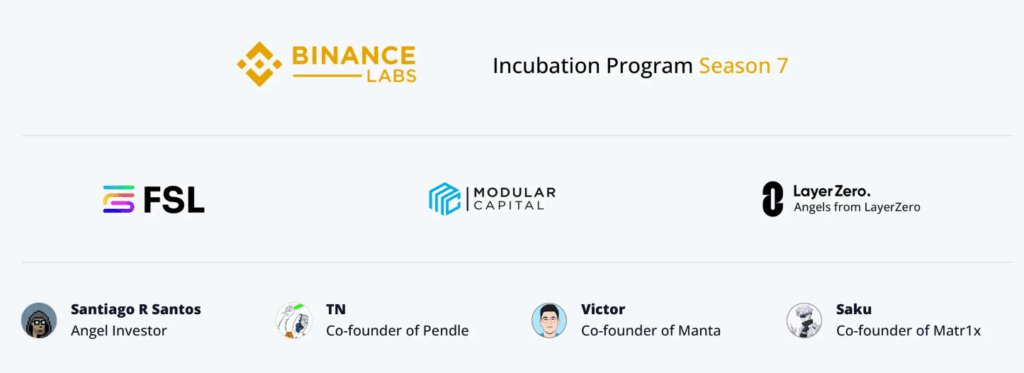

Investors and Partnerships

Dill has established strategic partnerships with leading investors and blockchain projects to expand its ecosystem and accelerate DL token adoption. Validator partners enable secure and scalable dApp deployment. DL token will soon be listed on Binance Alpha.

- Binance Labs: Strategic support via Season 7 Incubation Program.

- FSL (Find Satoshi Lab): Early-stage investor and Web3 expert.

- Modular Capital: Supports the project’s technical vision.

- LayerZero Angels: Investors supporting cross-chain communication goals.

- Individual Backers: Santiago R Santos, TN (Pendle), Víctor (Manta), Saku (Matr1x).

Project Concept

Dill aims to solve the blockchain trilemma, providing high decentralization, scalability, and security simultaneously. The platform enables independent execution environments for applications, allowing dApps to use their own resources efficiently, with low fees and high performance.

Ethereum Limitation: Layer-2 solutions fragment the ecosystem, limiting Ethereum’s overall dApp impact.

Solana Limitation: High scalability compromises decentralization.

How Dill Works

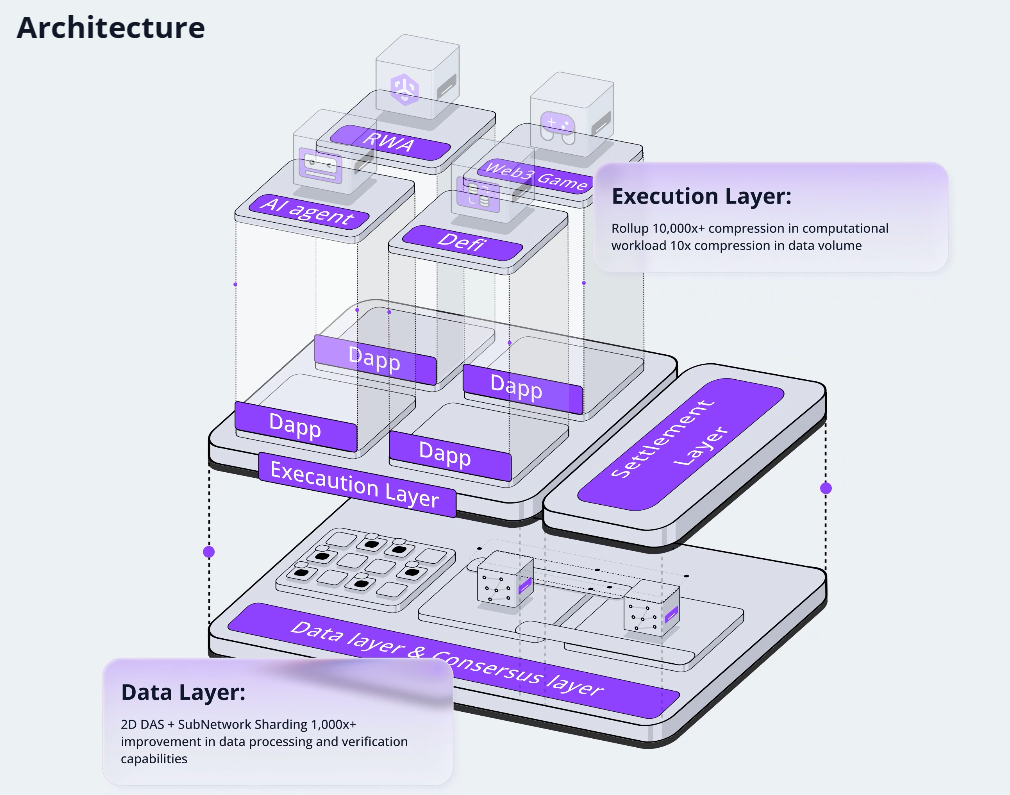

Dill is a modular, sharded L1 blockchain built for scalability and decentralization. It has four main layers:

- Base Layer – Handles consensus and data, securing the network with hundreds of thousands to millions of validators.

- Settlement Layer – Ensures transaction finality and collects proofs, supporting security and validator rewards.

- Execution Layer – Offers application-specific execution environments for independent operation and unlimited scalability.

- Bridge Layer – Facilitates secure data and asset transfer between applications and layers, enhancing ecosystem interaction.

Two-Tier Staking Model

Dill uses a two-tier staking system for light and full validators. Light validators enable easy participation, while full validators ensure economic security and network stability, balancing decentralization with security.

Governance

Governance is conducted via token holders and validators. Validators play active roles in block production and consensus, ensuring both network security and participant involvement.

Roadmap

- Q3 2025 – Mainnet Launch: Launch of Dill mainnet with high scalability, security, and decentralization.

- Q4 2025 – Ecosystem Launchpool: Launchpool supports new projects and dApps.

- Q1 2026 – Third-Party Bridge Integration: Enables cross-chain asset and data transfers.

- Q2 2026 – Secure Native Bridge: A native bridge for secure, efficient cross-chain communication.

$DL Token – Use Cases and Distribution

Purpose: Dill provides a modular, sharded L1 blockchain for high-performance, economically independent dApps.

- Total Supply: 6,000,000,000 DL

- Max Supply: 6,000,000,000 DL

- Circulating Supply: 1,180,000,000 DL

Primary Uses

- Network security & staking rewards

- dApp operations: execution environments, sharding, bridge access

- Launchpool participation: early access & token rewards

- Governance: voting on upgrades, parameters, and ecosystem initiatives

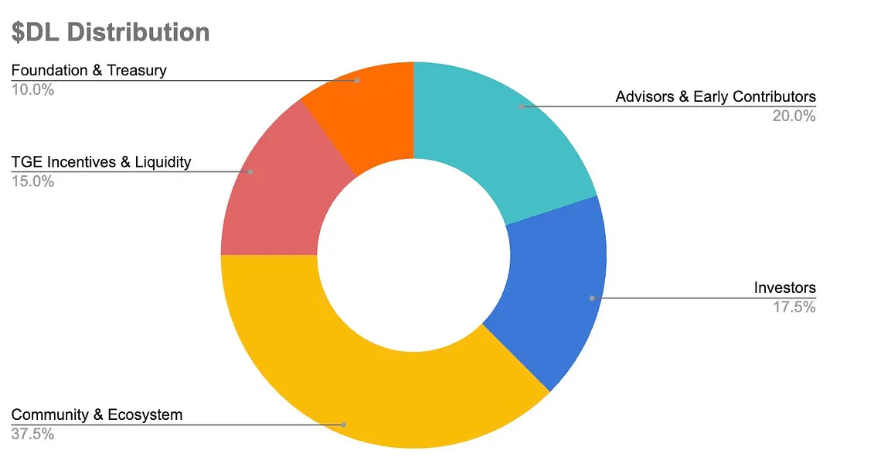

Token Distribution

- TGE Incentives & Liquidity: 15% (900M)

- Ecosystem & Community: 37.5% (2.25B)

- Foundation & Treasury: 10% (600M)

- Early Contributors & Advisors: 20% (1.2B)

- Investors: 17.5% (1.05B)

- Vesting: Gradual release over 10–36 months for long-term growth.

Staker Benefits

- Higher staking yields

- Early access to innovative dApps

- Governance participation

- Launchpool rewards in $DL and partner tokens

- $DL is more than a token; it powers a decentralized economy supporting dApp development.

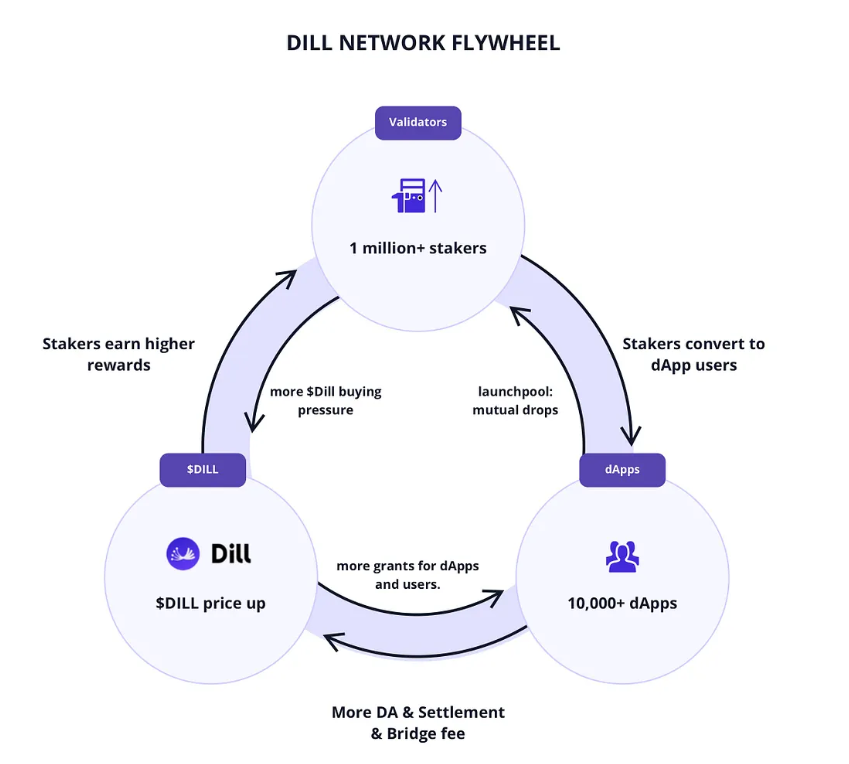

Ecosystem

Dill’s ecosystem includes validators, dApps, game developers, and AI agents. Launchpool and mini-pool staking enhance user and developer engagement, boosting DL demand and network security.

Features

- 800,000+ TPS and high data throughput

- Supports up to 1 million validators

- Two-tier staking model

- Fast transaction finality with three-slot consensus

- Application-specific execution environments

- Low hardware requirements for light validators

- Optimized for AI agents and fully on-chain games

Official Links

You can freely share your thoughts and comments about the topic in the comment section. Additionally, please don’t forget to follow us on our Telegram, YouTube and Twitter channels for the latest news and updates instantly.