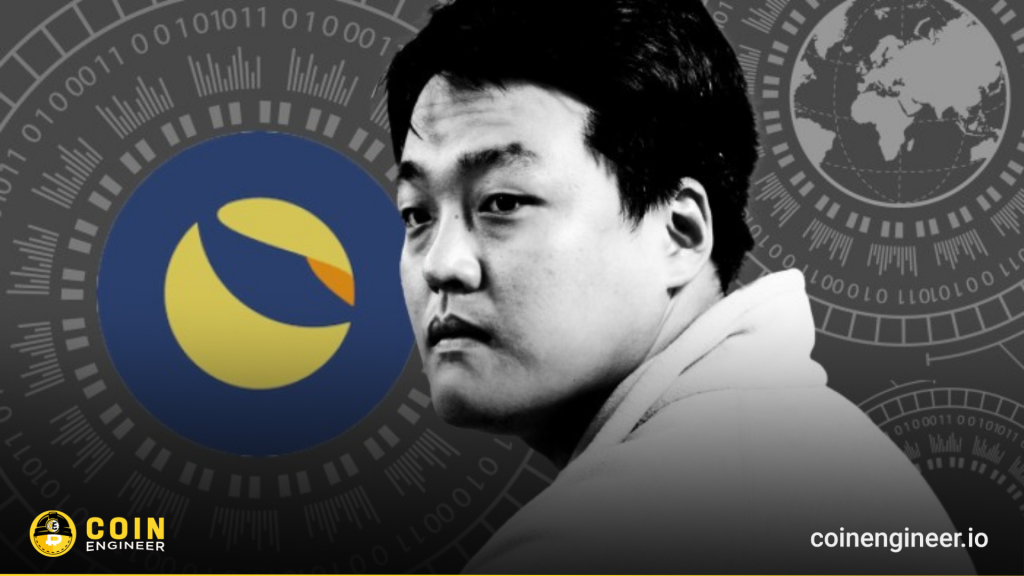

Terraform Labs co-founder Do Kwon is set to plead guilty in a U.S. court to two charges — “conspiracy to defraud” and “wire fraud” — in connection with the $40 billion collapse of the TerraUSD (UST) stablecoin in 2022. This decision marks a major turning point after Kwon had previously denied all allegations.

Do Kwon’s Guilty Plea and Latest Developments

During the U.S. court hearing, the judge confirmed that Do Kwon will admit guilt to the two main charges of conspiracy to defraud and wire fraud. This development is considered a critical step in the legal process surrounding the collapse of TerraUSD, which sent shockwaves through the crypto market.

The TerraUSD Crisis and Do Kwon’s Legal Journey

In 2022, TerraUSD (UST) — a stablecoin with a market value of $40 billion — and its sister token Luna collapsed, creating a massive shock in the crypto market. Billions in investor funds were wiped out, many firms went bankrupt, and the broader market entered a deep crisis.

Following the collapse, Do Kwon faced multiple serious charges including fraud, market manipulation, money laundering, and wire fraud. In 2023, he was arrested in Montenegro while attempting to flee with a forged passport and was held for nearly a year before being extradited to the United States.

In April 2025, the U.S. Securities and Exchange Commission (SEC) sued Kwon and Terraform Labs, accusing them of misleading investors. Kwon agreed to pay $4.47 billion in damages and liquidate company assets to compensate victims.

A Key Turning Point for the Crypto Industry

Kwon’s guilty plea is seen as one of the most significant legal moments in the history of altcoin and blockchain-related cases. It also reflects growing regulatory scrutiny over algorithmic stablecoins and complex financial models.

The case highlights the challenges of prosecuting cross-border crypto crimes. The jurisdictional dispute between the U.S. and South Korea revealed just how complicated regulation and enforcement can be in a market without clear geographic boundaries.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.