As the U.S. dollar shows renewed signs of weakness, global markets are focusing closely on both the Dollar Index (DXY) and Bitcoin. With rising expectations of possible intervention in the Japanese yen market, the DXY has fallen to its lowest level in four months. Historical data suggests that a weakening dollar, when supported by favorable liquidity conditions, tends to create a supportive environment for Bitcoin and other risk assets.

Why Is the Dollar Index Falling?

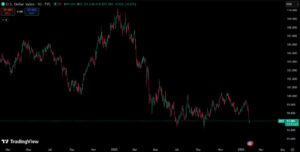

The U.S. Dollar Index (DXY) has declined to around the 96.8 level, marking its lowest point in the past four months. This drop places the dollar more than 15% below its 2022 peak and represents one of its weakest performance periods since 2017. According to experts, pressure on the dollar has intensified as expectations of a potential intervention in the Japanese yen market have strengthened.

Reports that the U.S. Federal Reserve has contacted major banks to assess conditions in the yen market are being interpreted as early signals of a possible currency intervention. Following these developments, the dollar rapidly lost value against the yen, approaching the 154 yen level. Japanese officials have also stated that they are prepared to intervene if currency movements become abnormal. Confirmation of discussions with U.S. officials has further increased expectations of coordinated action.

What Does a Weak Dollar Mean for Bitcoin?

Historically, Bitcoin and the U.S. dollar have shown an inverse relationship. When the dollar weakens, risk assets such as Bitcoin tend to perform more strongly. The sharp decline in the Dollar Index in 2017 coincided with the beginning of Bitcoin’s historic rally, during which it rose from below $200 to nearly $20,000.

Today, commentators increasingly suggest that a similar macroeconomic backdrop may be forming. Crypto analyst TED highlights that Bitcoin’s correlation with the Japanese yen is close to record highs. Accordingly, a potential strengthening of the yen following intervention could also act as a supportive factor for Bitcoin. It is noted that during past yen intervention periods, Bitcoin first experienced a weekly decline of around 29%, followed by a rapid surge of up to 100% in a short time.

Arthur Hayes’ Strong Forecast for Bitcoin

BitMEX co-founder Arthur Hayes states that if global liquidity conditions begin to ease again, Bitcoin could see a sharp and rapid rise. According to Hayes, a renewed expansion of balance sheets by major central banks—especially the U.S. Federal Reserve—could inject additional liquidity into markets, acting as a strong catalyst for scarce-supply assets like Bitcoin. Under this scenario, Hayes predicts that Bitcoin could reach $200,000 by March 2026. In a more aggressive outlook, he even argues that levels as high as $500,000 could theoretically be possible if global capital flows increase much faster than expected.

Despite these bullish expectations, Bitcoin is currently trading around $87,615 and has declined by approximately 1% over the past 24 hours. Analysts suggest that while this points to a cautious and volatile market structure in the short term, a weakening dollar and strengthening expectations around global liquidity could provide a supportive foundation for Bitcoin in the medium term. For this reason, investors are advised to focus less on short-term price movements and more on broader macroeconomic developments.

Assessment

The Dollar Index falling to a four-month low stands out as an important development that could revive risk appetite across global markets. While historical examples show that periods of dollar weakness often coincide with upside potential for Bitcoin, investors are reminded of the importance of closely monitoring macroeconomic developments and the actions of central banks.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.