On July 22, 2025, the cryptocurrency market witnessed significant investor activity in both Bitcoin and Ethereum ETFs. Spot Bitcoin ETFs saw a net outflow of $68 million, while Ethereum ETFs recorded a massive inflow of $533.8 million—highlighting a shift in investor portfolio preferences.

Ethereum ETFs Continue Their Climb

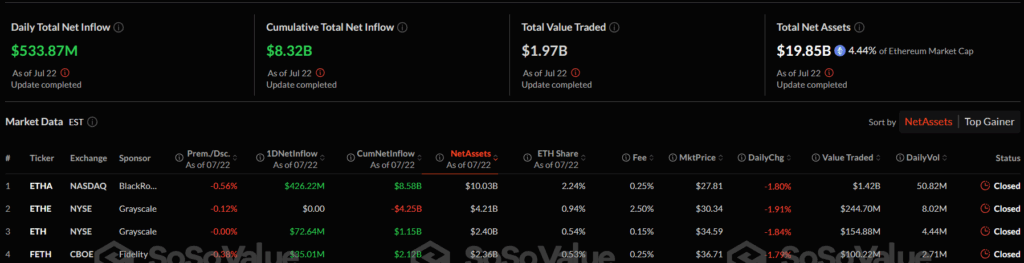

Spot Ethereum ETFs attracted substantial interest from investors. According to recent data, Ethereum ETFs experienced a net inflow of $533.8 million. This significant figure reinforces investor confidence in Ethereum-based products and has had a notable impact on ETH’s market capitalization.

The strong demand for Ethereum ETFs signals continued investor belief in ETH’s potential. Among daily net inflows, major players like BlackRock’s ETHA led the way with a one-day inflow of $426.22 million. Grayscale’s ETH fund followed with $72.64 million, while Fidelity’s FETH drew $35.01 million.

The total net assets of Ethereum ETFs continue to rise. ETHA’s assets reached $10.03 billion. Grayscale ETH now holds $2.40 billion in net assets. Overall, cumulative net inflows into Ethereum ETFs have reached $8.32 billion—indicating widespread adoption. Trading volumes also increased, with a total daily trading volume of $1.97 billion.

Bitcoin ETFs: Recent Trends and Comparison

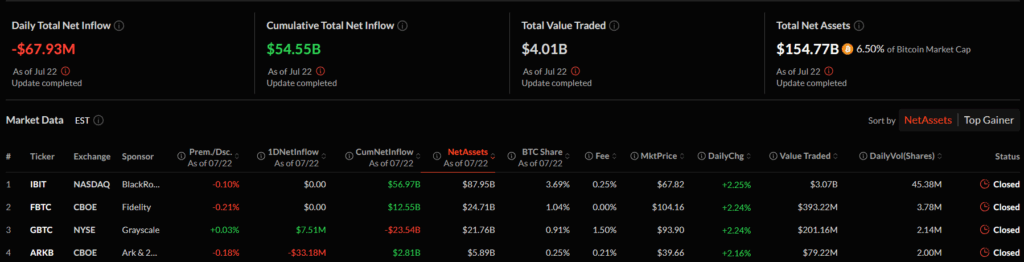

Meanwhile, a different trend was observed in Bitcoin ETFs. As of July 22, there was a net outflow of $67.93 million from Bitcoin ETFs. This trend suggests a shift toward portfolio diversification. Bitcoin ETFs currently have a cumulative net inflow of $54.55 billion and total daily trading volume of $4.01 billion.

This comparative data underscores the dynamic nature of the crypto market. Strong inflows into ETH ETFs could positively influence Ethereum’s future performance, while the outflows from Bitcoin ETFs suggest investors are exploring alternative assets.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.