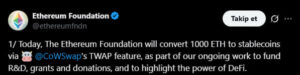

The Ethereum Foundation announced that it will convert 1,000 ETH (approximately $4.5 million) into stablecoins to accelerate ecosystem growth and support community projects. This move is part of the foundation’s strategy to fund research, development, grants, and donation programs. Through such strategic initiatives, the foundation aims to ensure the sustainable growth of the Ethereum ecosystem and provide continuous support for community-driven projects.

Purpose of the Stablecoin Conversion

According to the foundation, the ETH-to-stablecoin conversion will be executed using CoWSwap’s TWAP (Time-Weighted Average Price) feature. This method helps minimize price fluctuations, ensuring a more stable conversion process.

The foundation stated that this move aims to:

- Fund R&D projects

- Provide resources for community grants

- Support donation programs

- Strengthen the DeFi ecosystem

In its announcement, the foundation emphasized that this strategy is a critical step toward enhancing the sustainability of the Ethereum ecosystem.

Continuity with Previous Moves

This conversion follows the Ethereum Foundation’s 10,000 ETH stablecoin conversion last month, when approximately $43.6 million worth of ETH was converted into stablecoins via centralized exchanges for similar purposes.

Some users and analysts have suggested that the foundation could explore alternative strategies for fund management, such as utilizing DeFi lending platforms or over-the-counter (OTC) agreements to deploy ETH. These discussions highlight the importance of financial management strategies within the Ethereum community.

Ethereum Foundation’s Fund Management Strategy

The foundation outlined several principles for treasury management:

- Asset management considering risk, duration, and liquidity

- Adherence to Ethereum’s core principles

- Sustainable implementation of high-level grant allocation strategies

- Periodic improvement of fund management and allocation plans

This approach reinforces the foundation’s commitment to transparent, sustainable, and strategic financial management.

Importance of Using Stablecoins

This step underscores the critical role of stablecoins in project financing. Stablecoins provide a hedge against crypto market volatility while offering financial flexibility for long-term projects such as R&D, grants, and donations.

Experts note that such strategic moves support the sustainable growth of the Ethereum ecosystem and enhance investor confidence. Moreover, wider adoption of stablecoins increases financial management flexibility for DeFi and decentralized projects.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.