Ethereum has entered a period of renewed momentum, with on-chain data pointing to a sharp rise in both user participation and transaction volume. Recent network metrics suggest that this growth is not merely driven by existing users becoming more active, but by a substantial wave of new participants joining the ecosystem. This shift highlights a new phase in Ethereum’s adoption cycle.

Surge in First-Time Ethereum Users

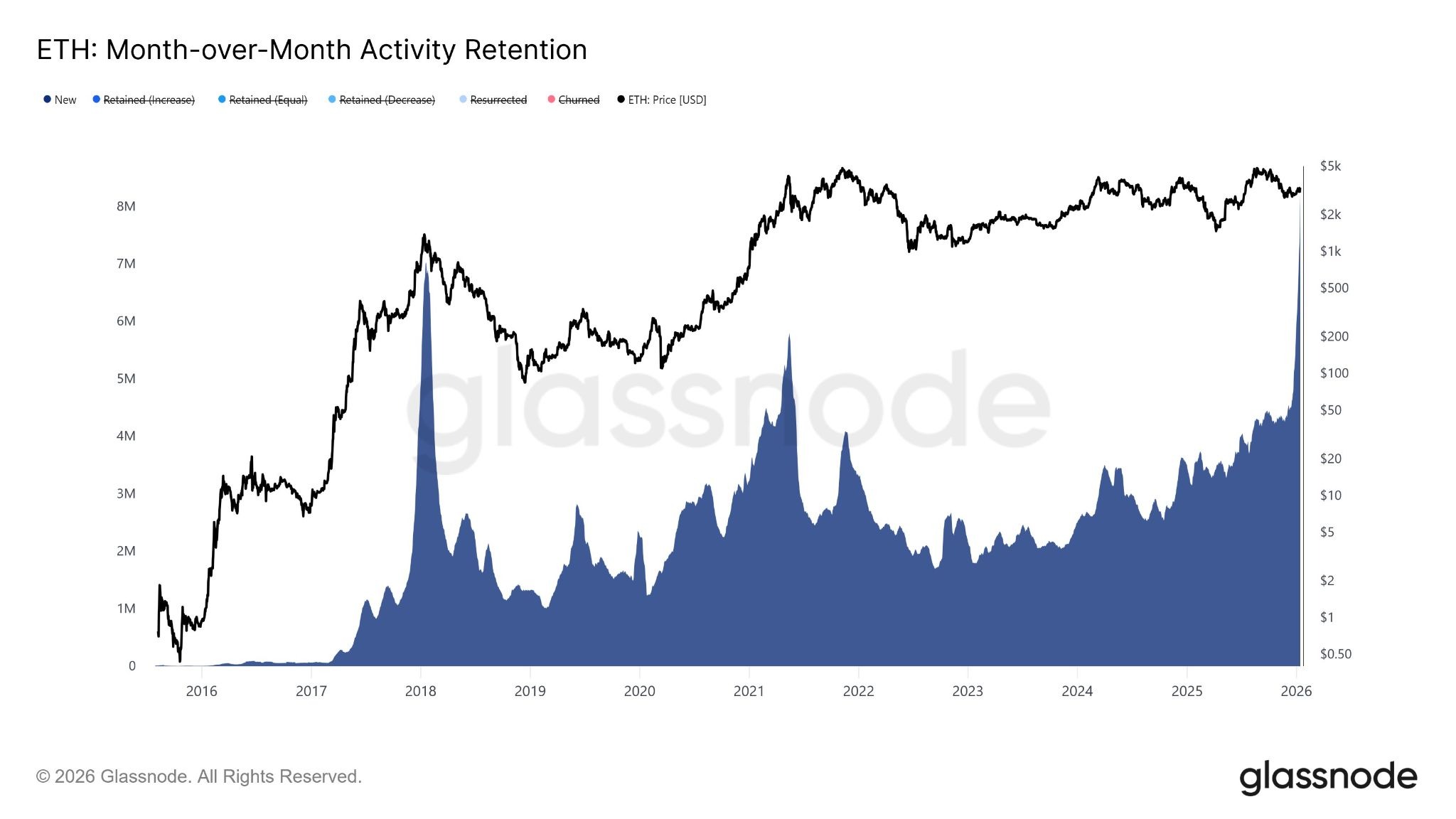

One of the most notable indicators of this expansion is the rapid increase in Ethereum’s activity retention metric. Over the past 30 days, the number of newly active addresses interacting with the network has nearly doubled, climbing from just over 4 million to approximately 8 million.

Activity retention is a key measure of whether users remain engaged with the network rather than interacting once and leaving. The latest figures indicate that Ethereum’s rising activity levels are being fueled by fresh wallets entering the ecosystem, rather than solely by long-term users increasing their transaction frequency.

This trend suggests growing interest in Ethereum across a broader user base, potentially driven by improved usability, lower fees, and expanding use cases.

Daily Transactions Reach Record Highs

The increase in network participation has been accompanied by a surge in transaction volume. Ethereum’s daily transaction count recently reached a new all-time high of 2.8 million, representing an increase of roughly 125% compared to the same period last year.

In parallel, the number of active addresses has more than doubled year over year. From around 410,000 active accounts twelve months ago, the figure has now surpassed 1 million. These metrics collectively point to a network experiencing sustained and diversified usage growth.

Stablecoins and Layer-2 Scaling Drive Growth

Analysts attribute much of this activity to the rapid expansion of stablecoin usage on Ethereum. At the same time, the network’s scaling strategy has played a critical role. By shifting execution to Layer-2 solutions while maintaining secure settlement on the Layer-1 chain, Ethereum has significantly reduced transaction costs and improved throughput.

This architecture allows the network to handle higher demand without compromising security, reinforcing Ethereum’s position as a scalable financial infrastructure.

Rising Optimism Around Ethereum

The uptick in on-chain activity has contributed to improving sentiment across the Ethereum ecosystem. Staked ETH has climbed to nearly 36 million, while ongoing capital inflows through ETFs and native crypto protocols strengthen the network’s fundamentals.

Combined with recent technical upgrades and growing institutional engagement, these developments suggest Ethereum may be well positioned for continued growth in the near term. Overall, the data reflects a maturing network supported by strong user adoption and expanding real-world usage.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.