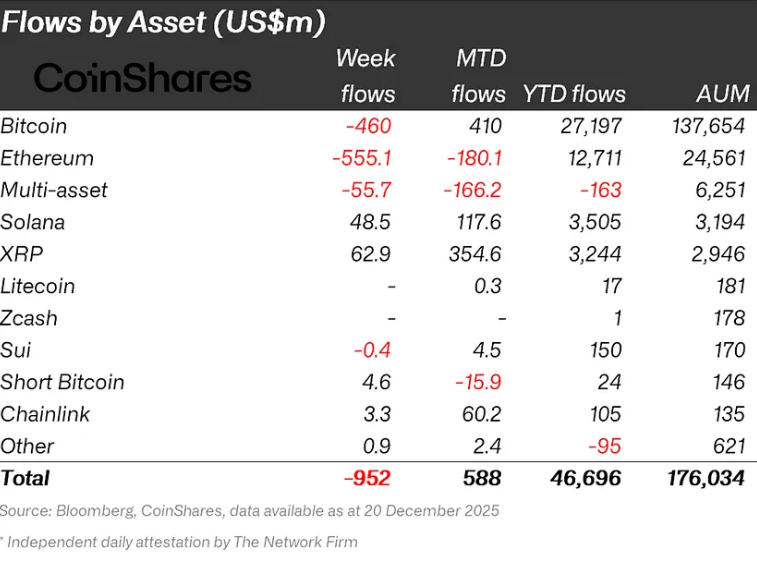

Ethereum investment products recorded their sharpest weekly outflows in over a month as uncertainty surrounding the US Clarity Act weighed heavily on investor sentiment. According to the latest data, $555 million exited Ethereum-linked funds, placing the asset at the center of a broader pullback across digital asset investment products. Bitcoin followed closely, with $460 million in outflows, pushing total weekly withdrawals to $952 million.

This shift marks a clear change in market behavior. Investors appear to be responding less to price action and more to regulatory timing risk, particularly as delays in US legislation extend uncertainty around crypto oversight.

Why the Clarity Act Matters More for Ethereum

Ethereum’s exposure to regulatory outcomes is structurally higher than most digital assets. Its role in staking, decentralized finance, and smart contract execution places it closer to the core of US regulatory discussions. As a result, postponements tied to the Clarity Act tend to impact Ethereum products more directly and more rapidly.

Despite the recent pullback, ETH longer-term flow picture remains constructive. Since the start of 2025, Ethereum investment products have attracted $12.7 billion in net inflows, more than double the total recorded during the same period last year. Still, short-term positioning suggests that investors prefer to reduce exposure until regulatory clarity improves.

Bitcoin Weakness and Selective Altcoin Demand

Bitcoin also faced sustained pressure, with weekly outflows of $460 million. While year-to-date inflows remain strong, Bitcoin continues to trail its 2024 performance as prices struggle to regain momentum. Multi-asset products and smaller allocations, including Sui, also posted modest losses during the week.

In contrast, capital did not exit the market uniformly. Solana attracted $48.5 million, while XRP saw $62.9 million in fresh inflows, signaling a selective rotation rather than a full risk-off move. Chainlink remained marginally positive, reinforcing the view that investors are reallocating toward assets perceived as less exposed to immediate regulatory outcomes.

-

Ethereum: –$555 million

-

Bitcoin: –$460 million

-

Solana: +$48.5 million

-

XRP: +$62.9 million

Investor Behavior and Regional Flow Breakdown

The negative sentiment was overwhelmingly concentrated in the United States, where $990 million in outflows were recorded. Smaller withdrawals were observed in Sweden, Switzerland, and Hong Kong, suggesting that regulatory uncertainty remains a predominantly US-driven concern.

Rather than signaling a loss of confidence in crypto markets, the data points to a pause in risk-taking behavior. Investors appear to be waiting for legislative progress before re-engaging, particularly in Ethereum-focused products that stand to be most affected by regulatory outcomes.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.