Ethereum ecosystem entered a new phase in the final quarter of 2025, strengthening its integration with the global financial system. According to Token Terminal data, stablecoin transfer volume on the network surpassed $8 trillion, marking the highest level ever recorded. This surge reflects more than sheer transaction size. It signals a widening role for Ethereum within financial infrastructure.

Regulatory Clarity Accelerated Volume While Increasing Pressure

The acceleration in activity followed regulatory developments in the United States and Europe. The GENIUS Act in the U.S. and the EU’s MiCA framework reduced legal uncertainty for institutional participants. As decision cycles shortened, Ethereum became a more frequent choice for cross-border liquidity management. At the same time, rising usage intensified network congestion. Scalability limits and transaction costs are back at the center of the debate.

Ethereum Leads the Market as Competition Tightens

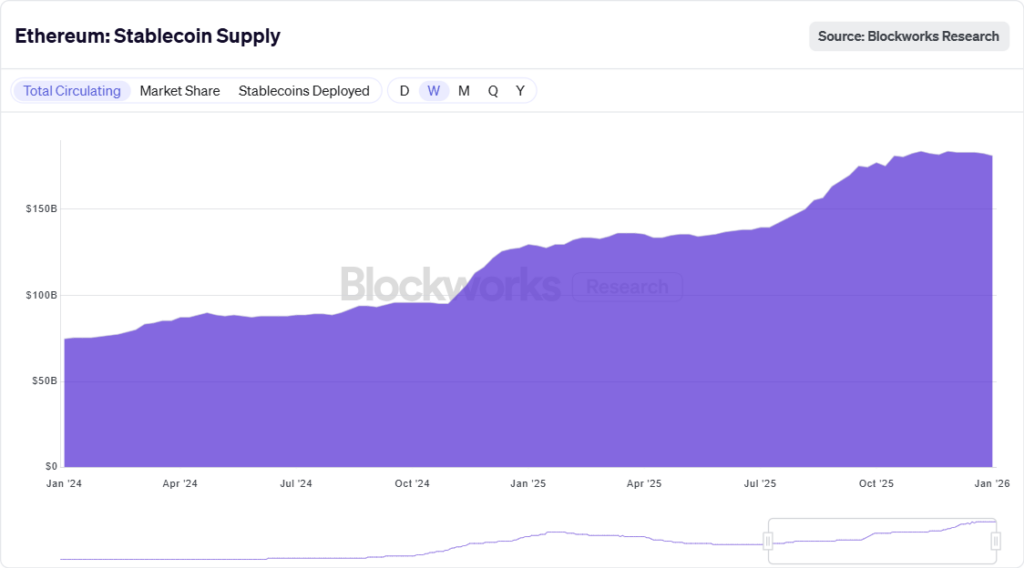

Ethereum maintains a 57% share of the stablecoin market. Roughly 60% of Tether’s USDT supply remains hosted on the network, reinforcing its dominant position. Tron follows with a 27% share, supported by lower transfer costs. This competitive pressure is expected to grow. In 2026, several European banks are preparing euro-denominated stablecoin initiatives that could challenge existing balances.

Where the Stablecoin Activity Is Actually Taking Place

The $8 trillion figure does not reflect activity on Ethereum’s mainnet alone. A growing portion of stablecoin transfers now occurs on Layer-2 networks such as Arbitrum, Optimism, and Base. This shift suggests that the mainnet increasingly serves as a settlement and finality layer rather than a venue for high-frequency transactions.

In this structure, Ethereum functions as the system’s financial endpoint. While this supports gas revenues and validator incentives, it also makes long-term sustainability more dependent on the performance of the Layer-2 ecosystem.

Network Activity Hits Records as Resilience Is Tested

By the end of December, monthly active addresses reached 10.4 million, while daily transactions climbed to 2.23 million. The data indicates that network growth is driven by operational and institutional usage rather than speculation alone. Even so, how Ethereum manages this intensity over time remains unclear. Technical capacity and cost efficiency are set to remain critical themes throughout 2026.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.