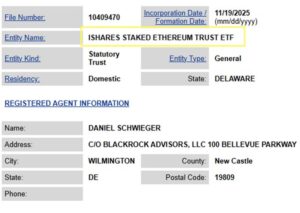

The world’s largest asset manager, BlackRock, is preparing to expand its presence in the Ethereum ecosystem. The company has officially registered the name “iShares Staked Ethereum Trust ETF” in Delaware, signaling that a new staking-focused fund is on the way. This move shows that BlackRock is no longer competing only in the spot Ethereum ETF arena but is now stepping into more advanced products that can offer staking rewards.

Delaware Filing Signals a New ETF in the Making

A name registration in Delaware is known as one of the first public steps in the creation of a new ETF. The filing was submitted by BlackRock Managing Director Daniel Schweiger, indicating that the fund is a high-level priority within the company. Schweiger was also responsible for the registration of BlackRock’s first iShares Ethereum Trust filed at the end of 2023.

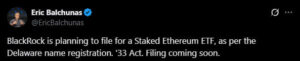

Bloomberg ETF analyst Eric Balchunas commented that the official application for BlackRock’s new staking ETF is “very close” and that the name registration signals the process is accelerating. According to Balchunas, this filing is “a strong indicator that BlackRock is preparing to launch a new fund.”

Nasdaq Previously Submitted Staking Update for ETHA

In July, Nasdaq submitted an updated 19b-4 filing to add staking functionality to BlackRock’s existing iShares Ethereum Trust (ETHA). This showed that BlackRock wanted to bring its existing product closer to Ethereum’s core feature — staking. This trend isn’t unique to BlackRock; several major asset managers offering Ethereum products are moving in the same direction:

- 21Shares submitted proposals to update its funds to include staking rewards.

- Grayscale requested approval to transition its Ethereum products into a staking model.

This shows that major fund managers are rapidly joining the race for staking-enabled ETFs.

Current Status of the ETHA Fund

ETHA remains the largest Ethereum ETF by assets under management. According to SoSoValue data:

- Total assets: ~$11.5 billion

- Recent market correction: $165 million in outflows

Despite the outflows, the scale of the fund suggests that adding staking could significantly boost investor interest. Under the second Trump administration, the SEC has shown a more flexible approach toward crypto products. This policy shift has led to the approval of ETFs that include staking rewards.

Next Phase in BlackRock’s Digital Asset Strategy

BlackRock’s Head of Digital Assets, Robert Mitchnick, previously stated that adding staking to ETH ETFs is “the natural evolution of the market.” According to Mitchnick, integrating Ethereum’s staking structure into institutional products is an inevitable step aligned with investor demand and technological maturity. He also described the SEC’s willingness to approve staking as “the next critical phase” for firmly integrating crypto assets into traditional finance.

Therefore, BlackRock’s new name registration in Delaware shows the company is now ready to turn this long-standing strategic vision into concrete action. It also reveals that BlackRock plans a more aggressive positioning in Ethereum with more advanced products.

Conclusion

BlackRock’s filing for the iShares Staked Ethereum Trust ETF strongly suggests that a far more sophisticated Ethereum ETF structure may soon be launched. Combined with the staking update application for the existing iShares ETHA fund, it is clear that BlackRock is preparing to take a major step into Ethereum’s staking ecosystem.

The rapid moves by major asset managers indicate that the competition for staking-based ETFs in the U.S. is heating up fast. The final shape of the process will become clearer with the SEC’s decisions in the coming weeks.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.