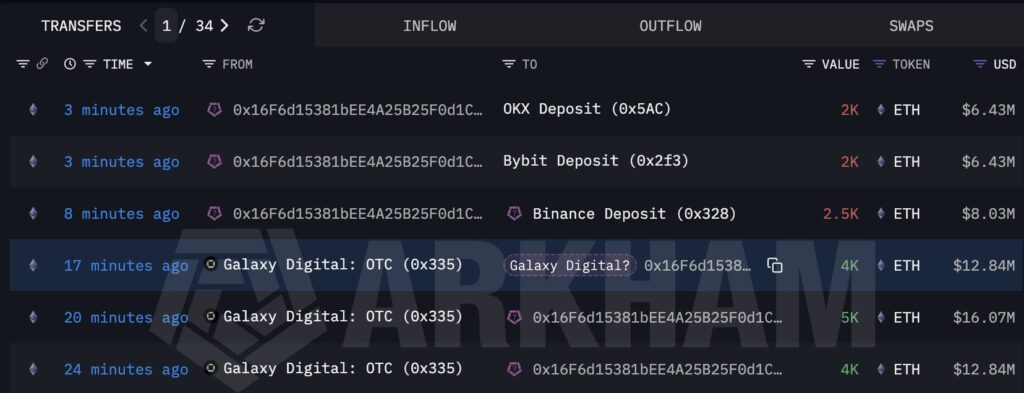

As January 2026 begins, pressure on the Ethereum market is building beyond simple price movements. Large investors and institutional players have redirected more than $110 million worth of ETH to centralized exchanges, prompting the market to reprice short-term selling risk.

This activity goes beyond isolated transactions. On-chain data points to a broader phase of position adjustments among large wallets. At a time when short-term price sensitivity is rising, increased ETH inflows to exchanges are directly influencing market psychology.

Whales Move Closer to Exchanges

Blockchain analytics show a clear concentration in large Ethereum transactions. A wallet tracked under the label 0xB3E8, which began accumulating ETH nearly eight years ago, transferred approximately 13,083 ETH—worth about $43.35 million—to the Gemini exchange last week. The wallet still holds 34,616 ETH, suggesting the move may not represent a full exit.

A similar operational shift emerged from Ethereum treasury firm FG Nexus. The company sold roughly 2,500 ETH, valued at $8.04 million, while maintaining a sizable balance of 37,594 ETH. With its previous sale dating back to November 2025, the timing of this transaction stands out.

Venture capital activity also reflects repositioning. A wallet believed to be associated with Fenbushi Capital reportedly sent around 7,798 ETH, worth approximately $25 million, to Binance. Notably, these funds had been staked for nearly two years, implying that the transfer may reflect strategic reallocation rather than pure liquidity needs.

Where Does Selling Risk Begin?

Market participants often interpret exchange inflows as early indicators of potential selling pressure. Centralized exchanges remain the primary venues for liquidity access and execution. However, such transfers do not always translate directly into spot sales.

Funds are frequently moved for internal rebalancing, collateral management, hedging strategies, or over-the-counter operations. As a result, rising exchange deposits increase short-term risk but do not automatically signal an imminent liquidation. The critical factor is whether these inflows become persistent.

Is U.S. Demand Losing Momentum?

Market-based indicators reinforce the on-chain narrative. The Coinbase Premium Index, which tracks the price difference between ETH/USD on Coinbase Pro and ETH/USDT on Binance, has remained in negative territory. This suggests weakening demand from U.S.-based institutional participants.

Historically, this metric turns positive during periods of strong institutional accumulation. Its current position points to a more cautious stance among U.S. investors.

A Different Story in Staking

In contrast, Ethereum’s staking data paints a more balanced picture. Validator queue data shows approximately 2.7 million ETH waiting to enter staking, creating an estimated 47-day activation delay. This backlog highlights sustained long-term commitment to the network.

Meanwhile, the exit queue remains limited to around 36,960 ETH. The imbalance between entry and exit flows suggests that while some large holders reduce exposure, the broader validator base continues to prioritize staking yields.

What Does the Technical Picture Suggest?

From a technical standpoint, sentiment is not uniformly bearish. Some analysts argue that Ethereum may be entering a renewed accumulation phase. Under this view, current price behavior reflects consolidation rather than an imminent sell-off.

Market commentator Crypto Gerla suggests ETH could be rebuilding momentum, with the $3,600 level re-emerging as a medium-term target. This scenario, however, depends on whether whale-driven exchange activity slows and U.S. demand stabilizes.

At present, Ethereum is navigating a delicate balance between selling pressure and staking-driven support. The data points to strategic profit-taking or risk management on the institutional side, while robust staking demand raises the possibility that incoming exchange liquidity could be absorbed without triggering sharp downside moves. How this balance resolves may shape not only price direction but also broader risk perception in the days ahead.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.