Ether.fi DAO has announced a $50 million ETHFI buyback program that will be activated if the token’s price falls below $3. This move is seen as part of a broader trend in decentralized finance (DeFi) to protect token value by reducing circulating supply. As of 2025, total buybacks across DeFi protocols have reportedly exceeded $1.4 billion, underscoring a growing shift toward sustainable tokenomics.

$50 Million Buyback Triggered Below $3

The Ether.fi community approved a governance proposal last week allocating up to $50 million from the DAO treasury for token repurchases. According to the plan, the buyback mechanism will activate whenever ETHFI’s price drops below $3, with purchases made directly on the open market. The Ether.fi Foundation stated that the initiative aims to support liquidity and stabilize token prices, ensuring long-term ecosystem resilience.

The program will remain active until one of the following conditions is met:

- The $50 million limit is reached.

- The foundation deems the program complete.

- A new DAO vote modifies or terminates the plan.

ETHFI Has Lost Over 89% of Its Value This Year

ETHFI has declined by more than 89% from its 2024 peak, trading around $0.93 as of October 31, placing it squarely within the buyback activation range. Market analysts view Ether.fi’s initiative as a DeFi adaptation of traditional corporate share buybacks — a mechanism used in traditional finance to protect value by reducing supply. For projects with strong revenue streams but weak secondary-market demand, such programs can help absorb excess supply and restore investor confidence.

The buyback program signals Ether.fi’s commitment to long-term value creation, potentially setting a precedent for other DeFi protocols to follow. Ether.fi’s latest initiative marks its entry into the rapidly expanding “token buyback” trend within the DeFi sector. According to CoinGecko’s 2025 report, total token repurchases conducted by DeFi protocols have surpassed $1.4 billion, reflecting a clear shift toward the “Protocol as a Business” model where project revenues are reinvested directly into tokenholder value.

Similar Buyback Moves Across DeFi

Ether.fi’s strategy aligns with a broader movement among leading DeFi protocols:

- Aave DAO recently proposed a $50 million annual token buyback plan, funded directly through protocol revenues to strengthen market depth.

- Uniswap and Aave collectively generated over $600 million in protocol income during the first three quarters of 2025, fueling new buyback cycles.

- OpenSea announced that it will allocate 50% of its revenue to buy back its SEA tokens.

- World Liberty Financial, the Trump-affiliated DeFi project, revealed plans to retire its governance tokens through a combined buyback-and-burn model.

Collectively, these examples highlight a growing trend where DeFi protocols are redirecting profits into mechanisms that directly benefit tokenholders, enhancing sustainability and community value.

Ether.fi’s Role in the DeFi Landscape

Ether.fi is a non-custodial liquid staking protocol built on Ethereum, allowing users to stake their ETH and receive liquid restaking tokens (ETHFI) in return. The platform enables participants to earn both base staking yields and additional returns through restaking, positioning it as a major liquidity hub in the DeFi ecosystem.

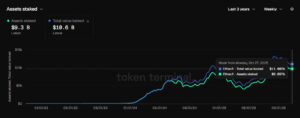

Currently, Ether.fi hosts roughly $10 billion in total value locked (TVL) and reports annual protocol revenues of around $360 million a strong financial foundation that ensures the buyback program’s sustainability. Experts note that Ether.fi’s move could set a precedent for future DeFi treasury management strategies, combining traditional corporate finance models with on-chain transparency and community-driven governance — a fusion that may redefine how decentralized protocols sustain long-term growth.

“DeFi Embraces Institutional Capital Management”

Market analysts view Ether.fi’s latest move as a clear sign of maturity within the DeFi sector. According to LVRG Research analysts, the initiative introduces a mechanism that mirrors traditional finance capital-efficiency models, positioning decentralized protocols closer to institutional-grade asset management practices.

The $50 million buyback plan approved by Ether.fi DAO is expected to boost investor confidence while setting a new benchmark for sustainable economic frameworks in decentralized finance. Experts emphasize that this move represents more than just a market intervention it’s a shift in DeFi’s economic philosophy, where protocol revenues are reinvested directly into tokenholder value to ensure long-term stability and growth.

With Ether.fi leading the way, DeFi appears to be entering a new era of financial discipline, adopting institutional-grade treasury management principles while preserving on-chain transparency and community-driven governance.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.