Renowned on-chain analyst Willy Woo has released fresh insights into the current state of the Bitcoin market, especially the underlying metrics that shape long-term investor sentiment. Woo, whose analysis often draw from deep blockchain data, warned that some widely accepted interpretations of the current market structure may no longer be accurate.

LTH Metric Losing Reliability

According to Woo, the commonly used Long-Term Holder (LTH) metric—defined as Bitcoin held for more than five months—has become outdated and increasingly misleading. While the metric once provided valuable insight into market cycles, Woo argues that relying on it today risks distorting the true state of investor activity.

He emphasized that the recent price declines cannot simply be attributed to long-term holders selling. Although he acknowledges that some LTH investors have indeed been offloading BTC, Woo stressed that these coins are not creating excess supply. Instead, they are being rapidly absorbed by new market participants or transferred into the treasuries of institutional players.

Woo described this as a form of custodial rotation, where Bitcoin changes hands without causing destabilizing selling pressure. This shift, according to the analyst, reflects structural maturity in the market rather than weakness.

Potential Upside Within Two Weeks

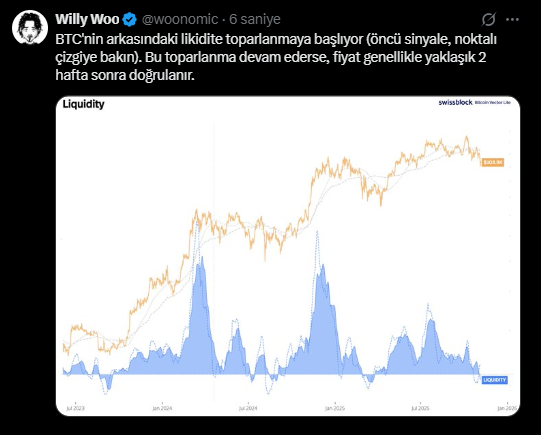

In a separate update shared on X, Woo highlighted early signs of recovery in Bitcoin’s liquidity indicators. He noted that if this upward trajectory continues, Bitcoin could enter a new upward phase within the next two weeks.

For Woo, improving liquidity signals that the market is gathering strength. This upward momentum, if sustained, could set the stage for a breakout, marking the beginning of a new price expansion phase.

Current Bitcoin (BTC) Market Outlook

Bitcoin is currently trading at $103,438, reflecting a 1.81% daily increase. Price action shows the asset moving within a tightening range, suggesting a period of consolidation. On-chain metrics indicate that major holders remain steady, while the broader market appears to be preparing for a directional shift.

Maintaining levels above $100,000 is seen by many analysts as a key psychological threshold. With liquidity flows gradually improving, the likelihood of an upward move continues to grow. As a result, the upcoming two-week period could prove pivotal for Bitcoin, both technically and structurally, as investors watch for signals of a confirmed trend reversal.

This content does not constitute investment advice.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.