The crypto currencies has recently been dominated by pessimism, with investor confidence sinking to levels not seen in over a year. While this environment may appear alarming at first glance, historical market behavior suggests that such intense fear can sometimes precede a meaningful rebound. Sentiment indicators are increasingly pointing toward a potential turning point rather than an extended downturn.

Social Media Sentiment Turns Deeply Negative

One of the most striking developments in the current market cycle is the overwhelming negativity across social media platforms. Investor discussions are heavily skewed toward fear-driven narratives, with bearish commentary significantly outweighing optimistic expectations. From a behavioral finance perspective, this imbalance is noteworthy.

Market psychology has long shown that extreme consensus in one direction often emerges near inflection points. When fear becomes widespread and dominant, selling pressure may already be exhausted. As a result, sentiment metrics at these levels are often interpreted as contrarian indicators rather than confirmation of further downside.

Fear & Greed Index Signals Heightened Caution

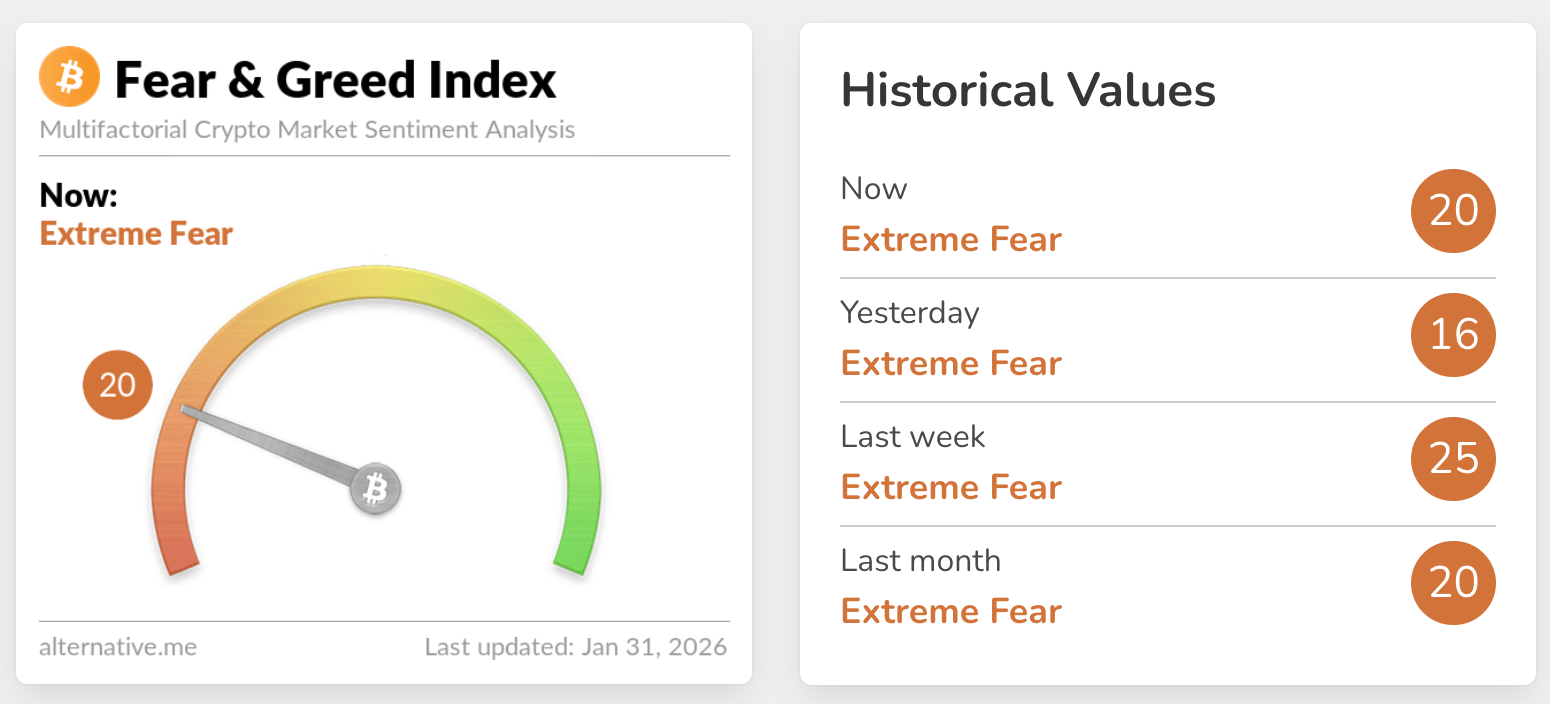

Broader sentiment data supports this view. The Crypto Fear & Greed Index recently dropped to 20, placing the market firmly in the “Extreme Fear” category. Just one day earlier, the index fell to 16, marking its lowest reading of 2026 and the weakest sentiment level since mid-December.

After briefly stabilizing in the “Fear” zone throughout late January, the index has once again slipped into extreme territory. This shift reflects rising risk aversion among market participants, typically driven by short-term price weakness and macro uncertainty.

Crypto Price Action Reinforces Market Anxiety

These sentiment readings coincide with a notable pullback in major cryptocurrencies. Bitcoin has declined nearly 7% over the past seven days, while Ethereum has fallen by more than 9%. At present, Bitcoin is trading around $83,950, and Ethereum is hovering near $2,690.

Bitcoin’s inability to reclaim the psychologically important $100,000 level since mid-November has fueled speculation about whether the market has entered a broader bearish phase. However, price consolidation below key resistance does not necessarily invalidate the longer-term trend.

Long-Term Signals Remain Constructive for Crypto

Despite near-term uncertainty, several structural indicators suggest that the current downturn in sentiment may be temporary. Expectations of a rapid capital rotation from traditional safe havens such as gold and silver into crypto appear premature, but this does not undermine the broader adoption trajectory.

Notably, traditional financial institutions continue to expand their involvement in digital assets. Increased hiring and infrastructure investment by major legacy players indicate that long-term confidence in the sector remains intact. From this perspective, today’s extreme fear may represent a pause within a much larger growth cycle rather than a definitive trend reversal.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.