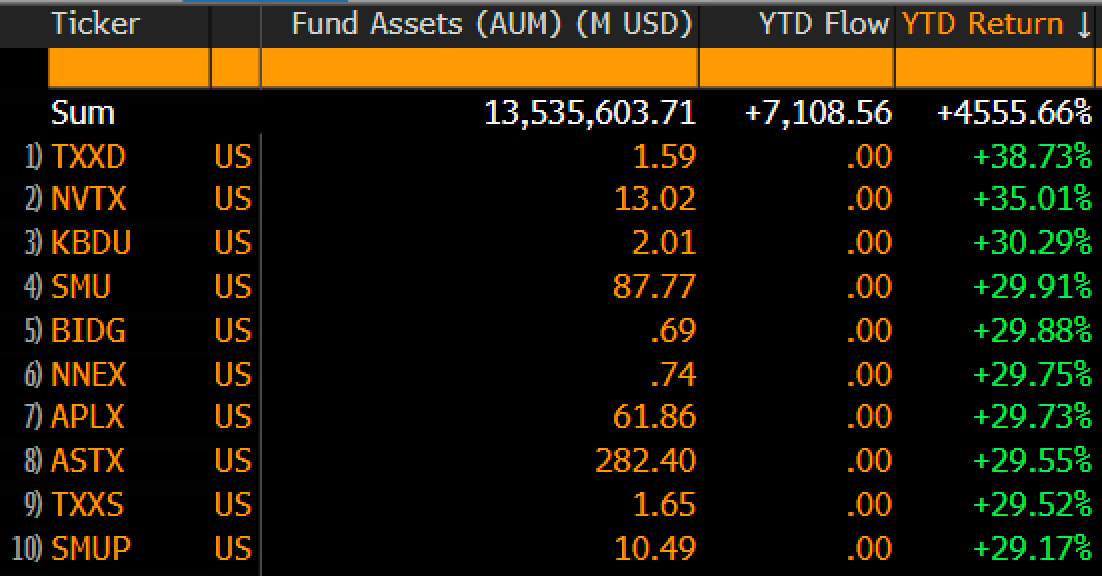

The opening days of 2026 have delivered an unusual picture in the ETF market. Products with elevated volatility have quickly climbed to the top of performance rankings, signaling a sharp rise in investor risk appetite early in the year. The clearest example of this trend is the 2x Dogecoin ETF (TXXD), which has emerged as one of the strongest performers across the ETF universe.

Market observers note that the best-performing ETFs at the start of the year are dominated by leveraged products, particularly a leveraged Dogecoin ETF alongside a 2x single-stock semiconductor ETF. This pattern highlights a clear preference for so-called “high beta” instruments, where investors seek amplified exposure rather than defensive positioning.

Dogecoin Stages a V-Shaped Recovery

Dogecoin itself has also shown signs of renewed momentum. After briefly dipping to the $0.146 level, the token rebounded swiftly, supported by a noticeable increase in trading volume. DOGE has since stabilized around $0.152, forming a textbook V-shaped recovery on short-term charts.

This price action has reinforced interest in leveraged exposure to Dogecoin. The strong showing of the 2x Dogecoin ETF near the top of year-to-date performance tables suggests that demand is not limited to the spot market. Instead, traders are increasingly using derivatives and ETF structures to express directional views on meme coins, particularly when momentum builds quickly.

Meme Coins as a Sentiment Barometer

In the early phase of the year, meme coins are once again acting as a real-time gauge of market sentiment. Sharp rebounds in assets such as Dogecoin and PEPE indicate that investors are leaning back into “meme season” narratives, especially in an environment where liquidity remains uneven.

Broader data supports this view. Indexes tracking meme-themed assets have shown renewed strength, while baskets focused on dog-themed cryptocurrencies have moved higher alongside DOGE. The resurgence of interest suggests that traders are prioritizing assets designed for rapid price movement and high responsiveness to sentiment shifts.

ETF Flows Reflect Rising Risk Appetite

This behavior is increasingly visible in ETF flows. A large share of the top-performing ETFs so far this year consists of leveraged and high-risk products, reinforcing the idea that risk-taking has intensified early in 2026. Such leaderboards are often viewed less as indicators of long-term fundamentals and more as snapshots of prevailing market psychology.

Bigger Picture: Sideways Bitcoin, So Dogecoin?

At the macro level, Bitcoin continues to trade within a relatively narrow range. When major assets struggle to establish a clear trend, speculative capital often migrates toward faster-moving segments of the market. Meme coins tend to benefit in these conditions due to their liquidity, active derivatives markets, and independence from macroeconomic catalysts.

Against this backdrop, the performance of the 2x Dogecoin ETF stands out not as a valuation signal, but as a strong reflection of current sentiment. The early-2026 landscape suggests that investors remain comfortable with aggressive positioning, keeping risk appetite firmly in the spotlight.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.