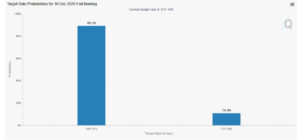

Recent macroeconomic data from the United States is reshaping market expectations regarding the Federal Reserve. The ADP private sector employment report came in sharply below expectations, fueling commentary that the Fed is approaching an “inevitable” point for rate cuts. According to the latest figures, the probability of a 25 bps rate cut at next week’s meeting has risen to 89%.

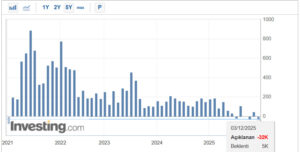

U.S. Employment Data Falls Far Below Expectations

The ADP private-sector employment data for November missed market forecasts by a wide margin. While economists expected an increase of around 10,000 jobs, the report instead showed a decline of 32,000. This is seen as one of the clearest indicators that the U.S. labor market is cooling rapidly.

Due to disruptions related to the government shutdown, economic data has been limited in recent weeks, prompting the Fed to give greater weight than usual to the ADP report. As a result, such a weak outcome has had a significant impact both on markets and policymakers.

Is the Fed Running Out of Room to Maneuver?

According to experts, the weak employment data is making it increasingly difficult for the Fed to resist mounting risks. Economists say that a rate cut at the December 10 meeting is now a high-probability scenario. This expectation has been rapidly priced in not only in macro markets but also in the crypto sector.

Financial firm Kobeissi summarized the situation briefly:

“With the labor market deteriorating this quickly, the Fed has no choice but to cut rates.”

This narrative and data flow also translated directly into crypto markets. As rate cut expectations surged, Bitcoin saw a notable intraday rebound. Investors began repositioning, anticipating that looser monetary policy will increase liquidity—benefiting Bitcoin.

Fed Members’ Recent Statements Reinforce Rate-Cut Prospects

In recent months, statements from Fed officials have increasingly focused on labor market weakness rather than high inflation. Officials have repeatedly noted that while inflation is moving along a more predictable path, employment is deteriorating faster than expected.

The unemployment rate rising to 4.4% shows policymakers have shifted to a more cautious stance regarding labor market risks. Officials warn that continued weakness could lead to a sharper slowdown in economic activity. As a result, the tone within the Fed has become noticeably more dovish, strengthening expectations of a rate cut.

FedWatch: Cut Probability at Recent Highs

The Chicago Mercantile Exchange’s (CME) FedWatch tool, a key gauge of market expectations, shows that the probability of a 25 bps rate cut has risen to 89%. Just a few weeks ago, this probability was below 30%. The rapid surge underscores how powerful and immediate the impact of new macro data has been on market sentiment. Investors increasingly believe that accelerating labor market weakness is forcing the Fed toward easing, and FedWatch data reflects how quickly this view has solidified.

Conclusion

Taking the latest data and market pricing together, the likelihood of a Fed rate cut now rests on a much firmer foundation. Weak job numbers, clear labor market cooling, rising recession signals, and dovish commentary from Fed members have turned the December 10 meeting into a critical turning point. Markets believe the Fed is preparing to shift away from aggressive tightening and enter a new rate-cutting cycle.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.