The U.S. Federal Reserve (Fed) is set to announce its highly anticipated interest rate decision tonight at 18.00 (UTC). Global markets largely expect a 25 basis point rate cut, marking a potential shift in the central bank’s monetary policy stance.

Market Expectations Lean Toward a Rate Cut

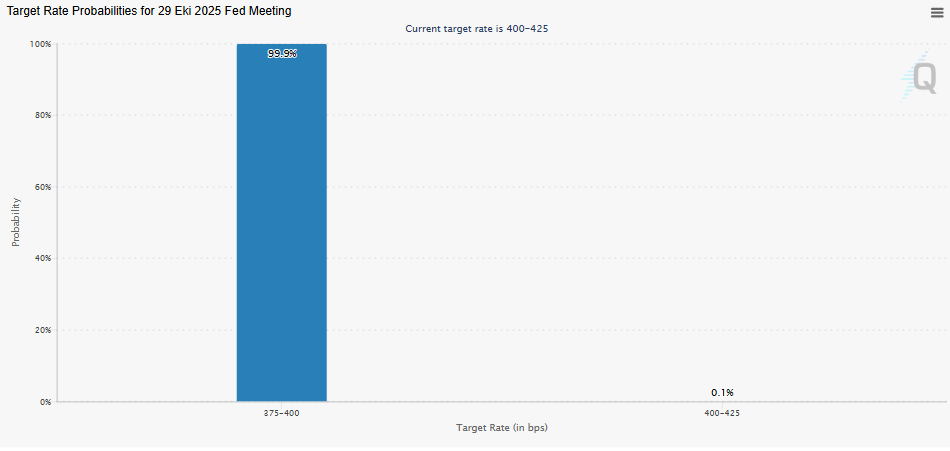

According to data from the CME Fed Watch Tool, the probability of a 25 bps rate cut is currently priced at 99.9%. While the decision itself appears to be a foregone conclusion, investors are far more interested in Fed Chair Jerome Powell’s comments following the announcement. His remarks will likely provide clues about the bank’s outlook for the coming months.

When Will Tightening End?

The key question for markets is whether the Fed is finally ready to end its tightening cycle. Powell has recently acknowledged the topic in his public appearances but has refrained from giving a specific timeline. If tonight’s statement or press conference hints at an imminent end to the restrictive policy phase, markets could interpret it as a bullish signal for risk assets.

However, if Powell reiterates that tight monetary conditions will remain in place for some time, investor sentiment may turn cautious. Such a stance could increase concerns about liquidity constraints across the financial system, particularly as funding markets show early signs of stress.

Focus Shifts to the December Meeting

Tonight’s announcement will set the tone for global markets ahead of the next Fed meeting in December. According to JPMorgan’s latest research note, the bank expects the Fed to signal the conclusion of its tightening phase during this week’s meeting.

Ultimately, tonight’s decision represents more than a routine rate adjustment—it could mark the beginning of a new phase in U.S. monetary policy. Powell’s guidance will be closely analyzed by investors worldwide, with potential ripple effects across currencies, bond markets, and even digital assets.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.