The latest U.S. employment data has caused a major shift in monetary policy expectations. Job growth in July came in well below forecasts. This weakness has rapidly strengthened expectations that the Federal Reserve (Fed) will cut interest rates in September.

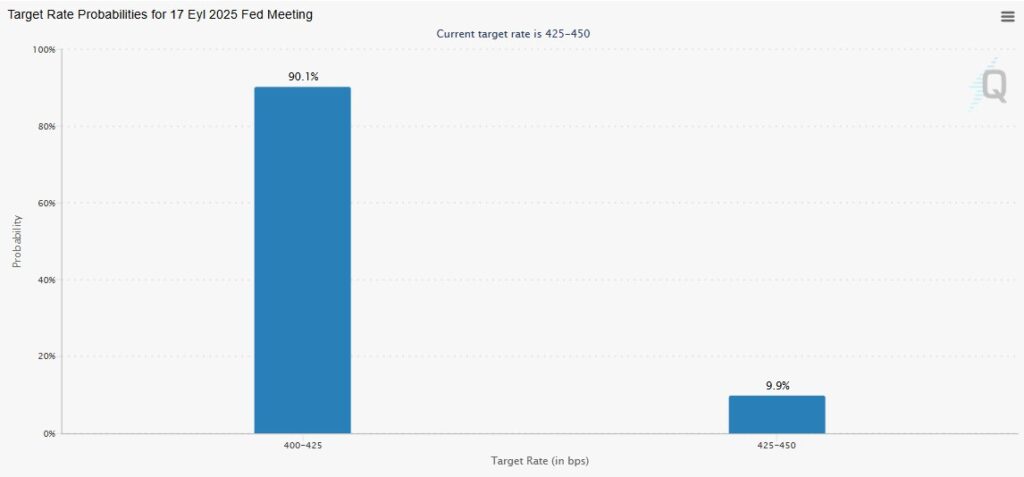

According to CME Group’s FedWatch Tool, the probability of a 25 basis point rate cut at the September 17 FOMC meeting has risen to 90.1%. Earlier in the day, this probability was calculated at 89.1%. This indicates that expectations have strengthened significantly during the day.

In contrast, the probability assigned by investors to rates being held steady is just 5.6%, showing how clearly the market is positioned for a rate cut.

Trump and the Fed Chairmanship: Another Factor Behind the Rate Cut Expectation

Meanwhile, another factor boosting the probability of a rate cut is Trump’s plan to appoint a new Fed Chair. President Trump is reportedly planning to replace Adriana Kugler, whose term is ending, with someone who favors rate cuts. Kugler has consistently voted against rate cuts throughout 2025. If she remains on the board until the September meeting, she is expected to vote again to keep rates unchanged.

The Fed has held the policy rate steady at the 4.25%–4.50% range since December 2024. No changes have been made over the last five meetings. However, the July 2025 non-farm payroll report, showing just 73,000 new jobs versus the expected 147,000, triggered a sharp market reaction. This gap has raised concerns about the strength of economic growth.

BlackRock’s 50 Basis Point Surprise Forecast: Cautious Optimism in Markets

Moreover, it’s not just a 25 basis point cut that’s on the table—there’s talk of a 50 basis point move. BlackRock’s Chief Investment Officer Rick Rieder suggested that a more aggressive cut in September is possible. According to Rieder, the Fed may implement two or three more cuts throughout the remainder of the year.

According to BlackRock’s institutional market outlook, current U.S. economic conditions demand a looser monetary policy. Inflationary pressures and slowing consumer spending further support this expectation.

Still, the timing and scale of the rate cut remain crucial. Investors are closely watching the Fed’s September decision. The pressure created by weak jobs data will largely shape the outcome.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.