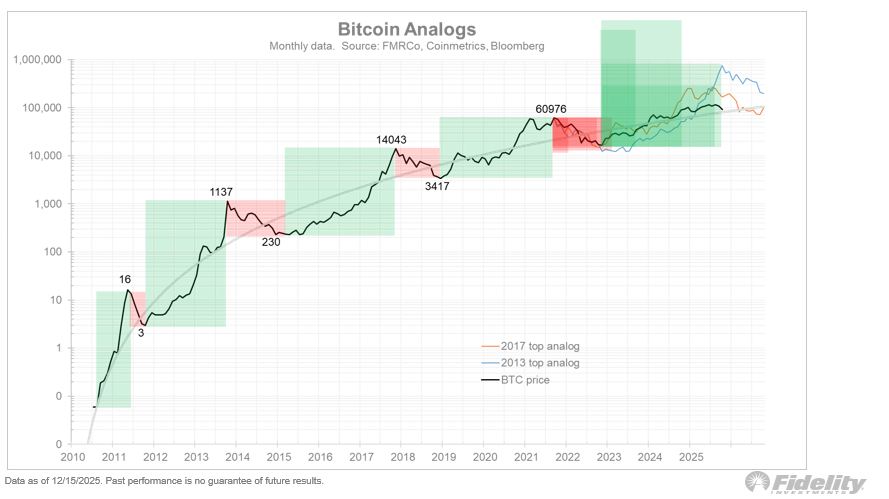

Debate around Bitcoin’s long-term trajectory has intensified once again as the world’s largest cryptocurrency shows signs of structural fatigue. According to Jurrien Timmer, Director of Global Macro Research at Fidelity, Bitcoin may be approaching the end of its historically recurring four-year market cycle. While maintaining a long-term bullish stance, Timmer suggests that the period ahead could look very different from what investors have grown accustomed to.

A Possible Bottom in 2026: $65,000–$75,000 Range

Timmer’s analysis points to Bitcoin having potentially peaked both in price and time during the current halving cycle. The rally that carried Bitcoin to a new all-time high of $125,000 on October 6 is viewed as a possible cycle top. Historically, Bitcoin bear phases have tended to last around a year, leading Timmer to believe that 2026 could represent a consolidation or “off year” for the asset.

In this scenario, Bitcoin could seek support in the $65,000 to $75,000 range. Despite this cautious outlook, Timmer emphasizes that his long-term conviction remains intact, describing himself as a “secular bull” who sees Bitcoin’s broader adoption trend as unchanged.

Analysts Divided on the Next Market Phase

Not all market participants share this conservative view. A number of crypto analysts argue that the current cycle may extend beyond historical patterns due to structural changes in the market. Increasing regulatory clarity and the expansion of institutional-grade crypto investment products are seen as potential catalysts for renewed upside.

Delphi Digital co-founder Tom Shaughnessy, for example, believes that the recent market turmoil represents a one-off liquidation event rather than the start of a prolonged downturn. From his perspective, once sentiment stabilizes, Bitcoin could revisit — and potentially exceed — previous highs in 2026.

Regulation and Institutional Adoption in Focus

Beyond price action, regulatory developments are expected to play a decisive role in shaping future valuations. In the United States, progress on stablecoin legislation is viewed as a foundational step toward deeper integration of digital assets into the financial system. Market observers note that the real impact will emerge during the implementation phase, including compliance frameworks and infrastructure alignment.

Short-Term Pressure Remains

In the near term, sentiment has weakened following Bitcoin’s dip below $85,000. Social media discussions have turned increasingly cautious, and on-chain data suggests continued short-term pressure. Notably, some large traders are positioning defensively on Bitcoin, while showing comparatively stronger confidence in Ether.

Overall, the outlook suggests that while Bitcoin’s long-term narrative remains intact, the path forward may involve heightened volatility and a more measured pace of growth.

This content does not constitute investment advice.

In the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube, and Twitter for the latest news and updates.