The latest on-chain analysis shared by Glassnode clearly shows that Bitcoin’s price is at a critical crossroads. According to on-chain data, BTC is currently trapped between strong selling pressure and key support levels. This picture indicates market indecision and a fragile balance between buyers and sellers. The report emphasizes that current price action is struggling to establish a healthy uptrend, while the overall market structure remains vulnerable. As a result, investors are closely focusing on critical support and resistance levels that could signal a potential shift in direction.

Bitcoin Price Is Squeezed Between Support and Resistance

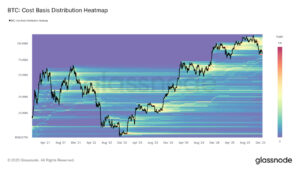

According to Glassnode’s analysis, Bitcoin is fluctuating between a strong support level around $81,000 and a heavy supply zone near $93,000. Price action within this range highlights the market’s difficulty in defining a clear direction. In particular, Bitcoin’s repeated failure to break above the $93,000 level shows that upward momentum remains limited.

Another notable point in the report is the concentrated supply pressure between $93,000 and $120,000. The analysis notes that although Bitcoin recently approached the $93,000 level, it encountered strong resistance and gradually pulled back to around $85,600. This dense supply zone stands out as one of the most important factors limiting further upside movement. Glassnode also points out that Bitcoin’s inability to surpass the 0.75% distribution threshold around $95,000 and the $101,500 level, which represents the cost basis of short-term holders, has weakened bullish momentum. Without sustained price action above these levels, it is difficult to speak of a strong upward trend.

$81,300 Emerges as the “True Market Mean”

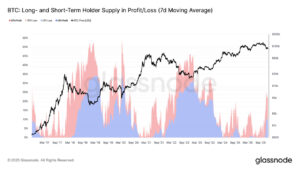

According to the analysis, the $81,300 level currently serves as a critical support for Bitcoin. Defined as the “true market mean,” this level is strongly supported by on-chain data. Glassnode data shows that the amount of Bitcoin held at a loss has risen to 6.7 million BTC, marking the highest level of the current cycle. Approximately 23.7% of the circulating supply is currently underwater, with 10.2% held by long-term investors and 13.5% by short-term holders. Glassnode warns that “if Bitcoin’s price falls below $81,300, loss-driven selling could increase, creating additional selling pressure.”

Current Situation in Spot and Derivatives Markets

In spot markets, demand is described as short-term and selective, while relative stability is observed on Coinbase. In contrast, major exchanges such as Binance show more volatile conditions. In futures and options markets, leveraged risk has decreased, and volatility is expected to remain limited through the end of the year.

Based on Glassnode’s on-chain analysis, Bitcoin is likely to continue moving sideways as long as the $81,000 support and $93,000 resistance levels remain unbroken. For market participants, these levels are critical for determining short- and medium-term direction. On-chain data suggests that uncertainty persists and investors are continuing to act cautiously.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.