Global markets are navigating choppy waters ahead of the US employment report. The dollar index has fallen to 96.79, while spot gold tests the $5,030 resistance. Market participants are closely watching Wednesday’s report. Experts say the expected 70,000 job increase could influence the Fed’s interest rate path.

Gold and Silver Quiet Before NFP

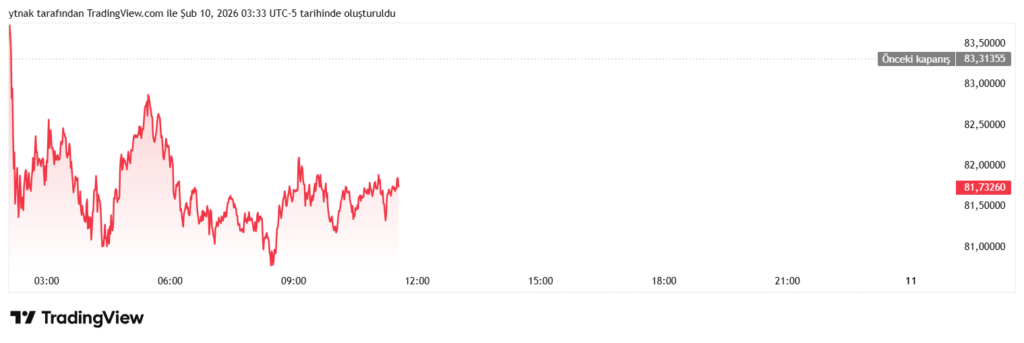

Spot gold continues to hover around the $5,030 range following historic peaks at the end of January. Silver has retraced 2.1%, a technical profit-taking move. Analyst Jigar Trivedi emphasizes that the underlying trend remains positive. Investors are avoiding large positions ahead of the US data. If employment figures fall short, gold could target $5,100. Silver prices are holding above the $81 support. This current pullback in the dollar resembles a calm before the storm.

Eastern Factors Weigh on the Dollar

The dollar’s global weakness is driven not only by domestic data but also by moves from East Asia. The Chinese yuan surpassed 6.91 for the first time since May 2023, gaining over 1% against the dollar. Local banks reducing exposure to US Treasury securities is adding pressure on the greenback. Asset diversification demand is one of the key factors behind the dollar index decline.

In Japan, Prime Minister Sanae Takaichi’s victory pushed the yen to 155.24. However, this recovery may not last. Takaichi’s potential use of the $1.4 trillion foreign exchange reserve for tax cuts raises concerns. Finance Minister Satsuki Katayama noted that surplus reserves could be used for food tax reductions. Analyst Carol Kong predicts that this fiscal loosening could push the dollar/yen rate to 164 by year-end.

Fed’s Rate Path and Expectations

US government shutdown delays have finally ended, bringing pending reports to the market. Kevin Hassett warns that employment growth could remain at 70,000 due to slower labor force growth and high productivity. This scenario weakens the Fed’s hand. Analysts expect it to strengthen the likelihood of a monetary easing cycle starting in June.

Market participants continue to price in two rate cuts this year, with the first expected in June. This expectation is creating short-term pressure on the dollar while fueling volatility in commodity prices. Other currencies remain stable, with the euro holding at 1.19125. Sterling faces pressure at $1.369 amid political crises. Investors are now focused not just on the data but on how the Fed reacts to it.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.