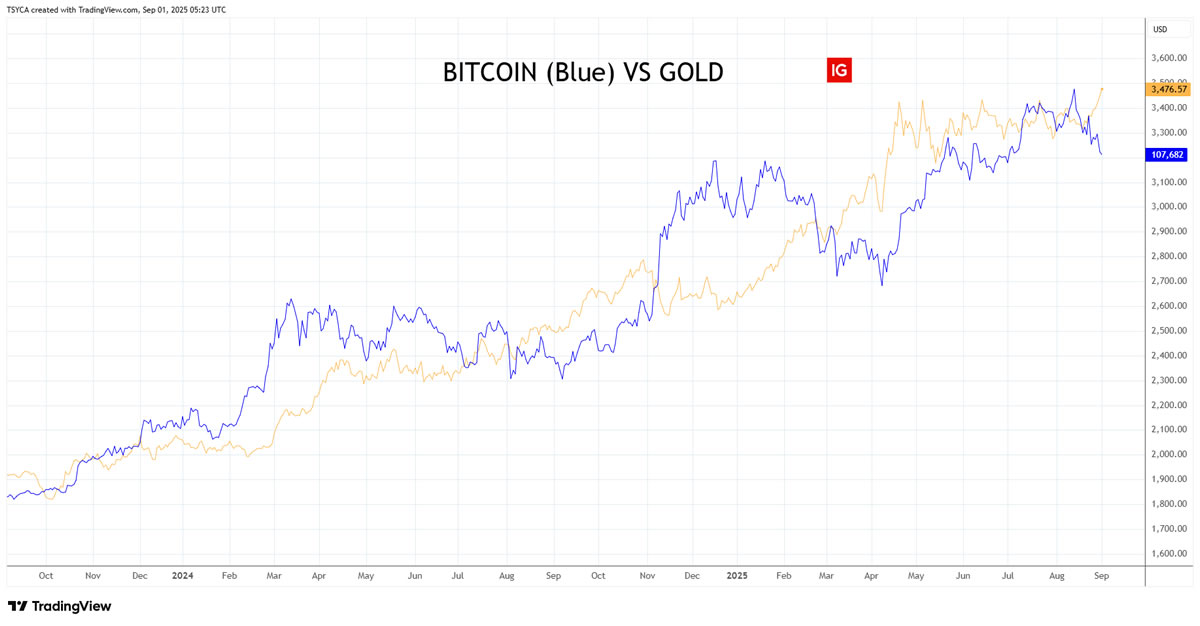

Gold has surged to an all-time high, while Bitcoin has moved in the opposite direction, falling to its lowest level in two months. Analysts see this divergence as a reflection of Bitcoin’s so-called “split personality.”

Gold Breaks Records as Bitcoin Slips

Following U.S. President Donald Trump’s social media post claiming that “prices are WAY DOWN in the USA, with virtually no inflation,” gold prices jumped. The precious metal climbed by 1%, reaching $3,485 per ounce, marking a new record high.

In contrast, Bitcoin took a downturn at the start of the week. According to Coinbase data, the leading cryptocurrency slid to $107,290, its lowest point since early July. This marks a correction of over 13% from the mid-August peak.

Has the Gold-Bitcoin Correlation Broken?

For the past two and a half years, gold, Bitcoin, and even the Nasdaq have often moved in tandem. Recently, however, this correlation has weakened. Market analyst Tony Sycamore attributes the shift to Bitcoin’s “dual identity”:

-

At times, Bitcoin is treated as a store of value or safe-haven asset.

-

At other times, it behaves more like a risk-on speculative asset.

This view is echoed by Vince Yang, co-founder of Ethereum layer-2 platform zkLink. According to Yang, gold remains the classic safe-haven asset, while Bitcoin is more closely tied to liquidity conditions and overall market risk. As a result, the two assets don’t always move side by side—instead, they can balance each other out.

Could They Realign Again?

Despite the current divergence, Sycamore believes the relationship between gold and Bitcoin could reassert itself. He suggests that if Trump pushes for an overheated economy and the Federal Reserve cuts interest rates while inflation persists, both assets could climb higher together.

“The key question,” he notes, “is at what level Bitcoin manages to stabilize and build momentum again.”

What Does Historical Data Say?

Past market cycles show that Bitcoin often lags behind gold’s rallies by several months.

-

In 2020, during the pandemic, gold crossed above $2,000 per ounce.

-

The following year, Bitcoin surged to new all-time highs.

Analysts argue that today’s divergence may also be temporary, with BTC simply trailing behind gold’s momentum.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.