Gold prices declined heading into the final trading day of the week, extending their downward momentum as stronger-than-expected U.S. employment data reduced the likelihood of a Federal Reserve rate cut in December. The resilience in the labor market reinforced expectations that the central bank may delay monetary easing, placing considerable pressure on the precious metal.

U.S. Employment Report Surprises to the Upside

The latest U.S. labor market report—delayed due to a federal government shutdown—showed that nonfarm payrolls rose by 119,000 in September. This figure more than doubled the market expectation of 50,000, signaling continued strength in the U.S. economy. Such robust data diminishes the urgency for the Federal Reserve to pivot toward looser policy and typically weighs on gold, which tends to benefit from lower interest rate environments.

Spot Gold Approaches a Weekly Decline

Spot gold fell 1.12% on Friday, slipping to $4,031.58 per ounce. With this move, the metal is on track for a weekly loss, struggling to find upward traction amid wavering global risk sentiment. The recent price action underscores the difficulty gold faces in sustaining momentum while rate expectations remain uncertain.

A Stronger Dollar Deepens Downward Pressure

The U.S. dollar index (DXY) strengthened toward its highest weekly close in a month, amplifying headwinds for gold. A firmer dollar increases the cost of the metal for buyers using other currencies, softening investment demand. Current market pricing suggests only a 39% probability of a rate cut in December. Because gold offers no yield, it typically performs better when borrowing costs are expected to decline—making the fading rate-cut outlook a direct drag on prices.

Fed Officials Signal Caution

Chicago Fed President Austan Goolsbee reiterated concerns over premature expectations for policy easing, emphasizing on Thursday that officials remain unsettled by early pricing of rate cuts. He highlighted that progress toward the 2% inflation target has stalled and may even be reversing, reinforcing the argument for a cautious approach.

Physical Demand Weakens Across Asia

Uncertainty surrounding the Fed’s policy path has also weighed on physical gold demand in Asia. Major markets in the region reported notably subdued buying interest this week, adding another layer of downward pressure on global prices.

Rate-Cut Expectations Continue to Fade

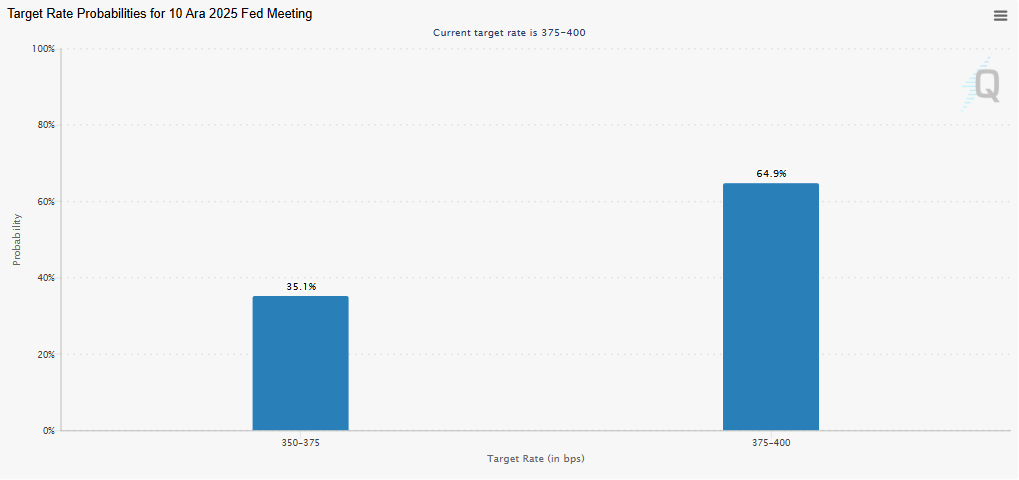

Futures markets indicate a noticeable shift in expectations for the December meeting:

-

35.1% probability of a 25 basis-point cut (350–375 bp)

-

64.9% probability of rates remaining unchanged (375–400 bp)

This distribution shows that markets increasingly believe the Fed will maintain its current stance. As rate-cut odds diminish, the near-term outlook for gold becomes more challenging, with persistent uncertainty likely to limit any meaningful recovery in prices.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.