Gold prices edged lower on Thursday as the U.S. dollar continued to firm and expectations for a Federal Reserve (Fed) rate cut in December lost momentum. With uncertainty still lingering from the recent U.S. government shutdown, market participants are turning their attention to the delayed nonfarm payrolls report for September, which is set to be released today.

Mild Pullback in Gold Prices

The precious metal opened the day slightly weaker, with spot gold slipping 0.2% to $4,066.81. U.S. gold futures for December delivery showed a similar pattern, declining 0.2% to $4,075.90. The subdued performance reflects how much optimism surrounding a near-term rate cut has faded in recent weeks.

Kelvin Wong, senior market analyst at OANDA, noted that expectations for a December policy shift have been scaled back sharply over the past two weeks. According to Wong, gold is likely to remain trapped below $4,100 in the short run unless a significant catalyst emerges. He identified resistance around $4,155, while a move toward the $4,000–$3,980 zone could come into play if downside pressure continues.

Fed Outlook Cools as Dollar Climbs

The dollar index climbed to its highest level in two weeks, making gold more expensive for investors holding other currencies. The stronger dollar, combined with diminishing confidence in a near-term Fed rate cut, has limited appetite for the metal.

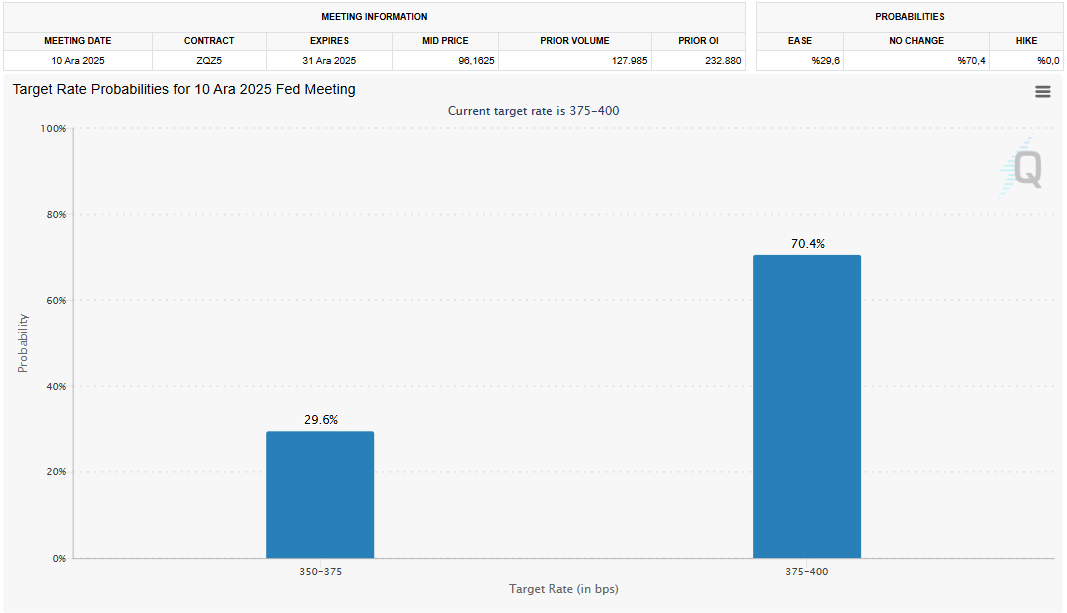

Adding to the cautious atmosphere, the October employment report—normally a market-moving data release—has been postponed until after the December FOMC meeting. This delay further weakened expectations for a rate cut at the December 9–10 gathering. According to the CME FedWatch Tool, the probability of a December cut has fallen from 49% to 29.6%. As a result, markets are closely watching today’s September nonfarm payrolls report for fresh direction.

ETF Inflows Signal Continued Institutional Interest

While prices softened, activity in gold-backed exchange-traded funds offered a contrasting signal. Holdings of SPDR Gold Trust, the world’s largest physically backed gold ETF, rose from 1,041.43 tons on Tuesday to 1,043.72 tons on Wednesday — an increase of 0.22%. The inflow suggests that institutional investors remain engaged despite recent volatility.

As traders await the latest labor market data, gold’s short-term trajectory will likely hinge on the interplay between dollar strength and shifting expectations for Fed policy.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.