As global markets continue to navigate economic uncertainty, Goldman Sachs has released an updated long-term outlook for gold. The investment bank now forecasts that gold will reach $4,900 by the end of 2026, signaling a notable upward trajectory. With spot prices currently hovering around $4,230, the projection implies a potential increase of approximately 15.8% over the next year.

Key Drivers Behind the Upward Forecast

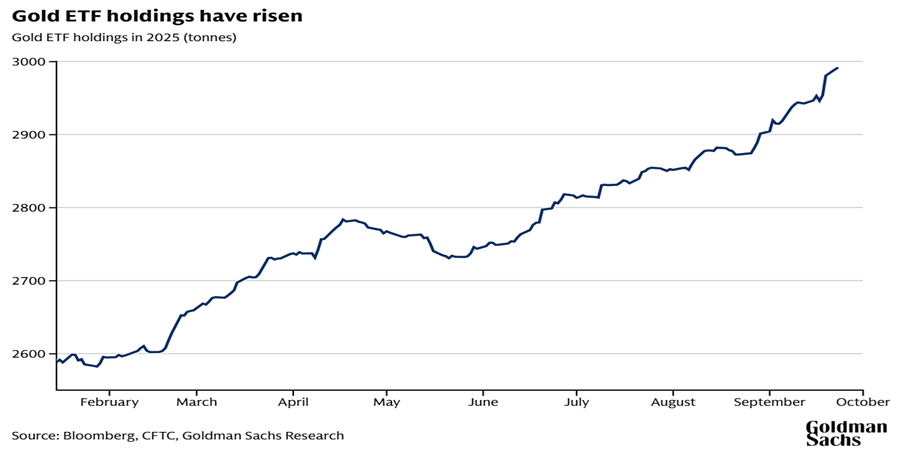

Goldman Sachs attributes its revised estimate to two dominant forces shaping the market: sustained inflows into Western gold-backed exchange-traded funds and persistent gold accumulation by central banks.

Analysts suggest that a shift toward monetary easing by the U.S. Federal Reserve could further stimulate ETF demand, exerting additional upward pressure on prices.

The bank emphasizes that structural demand is playing an increasingly important role in the long-term pricing outlook. Many central banks have been expanding their gold reserves as part of their broader diversification strategies, contributing to a steadily tightening supply-demand dynamic.

“Risks Remain Tilted to the Upside”

Despite the already optimistic target, Goldman Sachs notes that the balance of risks still leans toward further price appreciation. According to the bank’s analysts, greater diversification by private-sector investors could cause ETF holdings to exceed model-based projections. Should this materialize, gold prices may surpass even the newly updated forecast.

Two Distinct Buyer Groups: Believers and Opportunists

The bank’s research highlights that gold demand primarily arises from two types of buyers. The first group—often referred to as “belief-driven buyers”—includes central banks, ETFs, and speculative investors who continue to accumulate gold regardless of short-term price movements. Historically, every 100 tons of net purchases by this group correlates with an estimated 1.7% increase in gold prices.

The second group comprises opportunistic buyers, including households in emerging markets, who enter the market only when they perceive prices to be attractive. These buyers tend to support the market during price declines and act as a moderating force during rapid increases.

Goldman Sachs’ updated projection underscores the growing appeal of gold as a strategic asset in a shifting macroeconomic environment. With resilient central bank demand and strengthening ETF inflows, the precious metal appears poised to remain a focal point for investors in the years ahead.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.