As the ETF momentum in the crypto market continues to strengthen, this time the spotlight has shifted to the altcoin Chainlink (LINK). According to information shared by Nate Geraci, President of The ETF Store, the first-ever U.S. spot Chainlink ETF is expected to launch this week. This move is seen as a major milestone not only for LINK but for the entire altcoin ETF ecosystem. Experts believe the development marks the beginning of a new era, potentially increasing institutional access to altcoins across the sector.

First Spot Chainlink ETF Coming to the U.S.

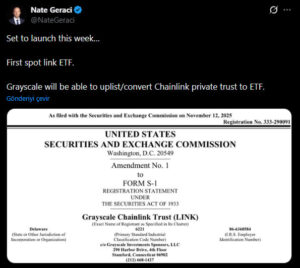

In a post on X, Nate Geraci stated that Grayscale has completed the necessary preparations to convert its existing Chainlink Trust into a spot ETF. According to Geraci, this conversion is not merely a technical update it is a crucial step that will enable institutional investors to gain direct exposure to LINK.

If the process is successful, the product will become the first spot Chainlink ETF traded on a U.S. exchange. With this transformation, the Chainlink Trust — established at the end of 2020 will be elevated into an ETF structure, making it accessible to a much broader range of investors after nearly five years.

How Will the LINK ETF Work?

The new product will follow Chainlink’s spot price directly. Additionally, the ETF will reportedly incorporate staking rewards earned from staking LINK into the fund structure.

This feature may allow investors to benefit from both:

- Spot price appreciation

- Staking-generated yields

Thus, indirect exposure to LINK may become significantly more attractive to traditional investors.

Grayscale’s expansion into altcoin ETFs extends beyond LINK. Last month, the company also introduced spot XRP and spot Dogecoin (DOGE) ETFs to the U.S. market. This broader expansion underscores growing institutional interest in the altcoin ecosystem.

Analysts commented on the development:

“Launching a spot ETF for Chainlink in the U.S. could increase institutional access and significantly boost LINK’s liquidity. The expanding ETF landscape signals a new era for altcoins.”

Conclusion

The spot Chainlink ETF that Grayscale is expected to launch this week highlights the rapid growth of regulatory-compliant investment products in the crypto market. By offering exposure to both LINK’s spot price and staking yields, the ETF provides institutional investors with a more secure and regulated pathway to participate in the Chainlink ecosystem.

With XRP and DOGE ETFs already on the market, the addition of LINK demonstrates intensifying competition and fast maturation in the altcoin ETF space. If expectations are met, the Chainlink ETF could become a significant catalyst for LINK’s price and liquidity.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.